5 minutes

Branch modernization puts digital at the center of the in-person experience.

Sponsored by Fiserv

For centuries, credit unions have forged relationships by establishing a physical presence in a community. Successful organizations grew by adding branches—in town squares, on busy thoroughfares and suburban developments.

With advances in self-service and digital technologies, many bank and credit union executives are reimagining the role of the branch. They’re creating experiences that blend the digital with the physical for members while providing employees with modern tools to support changing preferences.

This transformation is a welcome change as the next generations of digital natives come of age. And it’s a more complex proposition than might appear. Getting it right requires fine-tuning three critical elements.

The first is branch design, which includes things like branch size, self-service tools and the technology leveraged. The second is branch placement—reconsidering where each branch is located and why. A data-driven understanding of the market and an individual credit union’s performance in that market will shape these decisions.

The third component is the people factor. The mindset of the people who work in the credit union and their competencies must support the new paradigm or the results of the transformation will be muted. All three of these elements must work in harmony, and there are valuable lessons to learn from credit unions that have struck the right balance.

Analyzing the Business Value of Element One: Branch Design

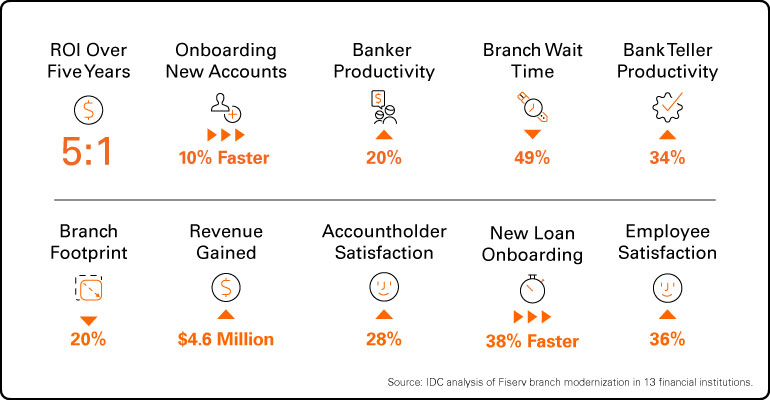

In 2022, Fiserv commissioned marketing intelligence firm International Data Corporation to analyze the impact of modernizing branch design elements. The result—“The Business Value of Branch Modernization”—compiled insights from 13 financial institutions that worked with Fiserv to analyze branch processes and implement recommended branch redesigns and technology solutions.

The recommended technology reduces costs by automating branch operations and providing in-branch self-service options. Examples include interactive branch kiosks, deposit solutions, biometric authentication, collaboration and scheduling systems, teller and workflow systems, card issuance, and hardware.

IDC estimates that interviewed companies will achieve five-year discounted benefits worth an average of $10.9 million per organization ($729,000 per transformed branch) through improved staffing, streamlined technology options and other advantages.

Branch Modernization Results

IDC found that modernization of branch design elements resulted in the following benefits.

Improved operations. Branch solutions help credit unions downsize their physical footprint without sacrificing service. IDC study participants reported an average 20% reduction in rental costs alone.

With access to self-service technology like interactive kiosks and cash recyclers, members are becoming more adept at cross-channel transactions. This efficiency reduces salary costs while freeing employees from tedious tasks to focus on more complex situations.

“A transformed branch allows bankers to focus on other things besides transactions. Tellers can open accounts. They couldn’t do that if they were doing normal teller activities. I’d say that tellers and bankers are 15–20% more productive.”

– Fiserv financial institution client participating in IDC analysis

Enhanced satisfaction. Banks and credit unions are capitalizing on the strengths of a physical branch to deliver better member experiences. Improved efficiency leads to shorter wait times, multichannel flexibility and a more knowledgeable staff—all of which impact member satisfaction.

“Our satisfaction score went up because there are more people to assist our accountholders, especially for complex situations. Before, they had to wait for people who had the expertise or skills to complete things for them.”

– Fiserv financial institution client participating in IDC analysis

Increased revenue. IDC predicts that credit unions implementing digital innovation will derive over 25% of their overall revenue from digital products, services or experiences. Innovative digital products and services can create additional business value through new partnerships, data monetization, entrance into new markets and other approaches.

“With branch transformation, we see that the efficiency of the technology allows us to spend more time on member needs. I’d say from where we were a few years ago, it’s probably $50,000–$60,000/month more in revenue.”

– Fiserv financial institution client participating in IDC analysis

Competitive advantage. Branch transformation helps smaller credit unions level the playing field with larger financial institutions by providing products that allow member to bank however they want, wherever they are—with the option for to stop in a local branch when they prefer to.

“The ability to compete is the biggest benefit for us. We have a small organization, so undergoing a branch transformation allowed us to compete with some of the larger organizations out there. I believe we’d be losing revenue if we didn’t do this.”

– Fiserv financial institution client participating in IDC analysis

Implementing innovative technology solutions. As credit unions grapple with maintaining relevance in a changing world, organizations like Fiserv provide technology solutions that support branch modernization. While there are many ways to modernize a branch, the most successful transformations use a data-driven approach to shape decisions about branch design and placement—and they don’t overlook the people factor.

Fiserv develops an individualized strategy based on needs, priorities and a plan to leverage existing solutions. A thorough assessment of the current branch network reveals challenges, opportunities and requirements that are translated into an actionable road map.

“Undergoing a branch transformation makes us a lot more efficient. It cuts down on wait time for accountholders and it gives people more flexibility in how they do their banking.”

– Fiserv financial institution client participating in IDC analysis

Remaining relevant. Branches will need to evolve now and into the future to remain relevant, requiring a strategic approach that is endorsed at the highest level within the organization and a willingness to think differently about the member experience.

This involves investment in branch redesign, thoughtful branch placement and a retooled staff that can be more consultative and less transactional while building out long-term relationships.

Theo Curey has been president, credit union solutions for Fiserv, a CUES Supplier member based in Brookfield, Wisconsin since 2019. He is responsible for serving Fiserv’s credit union clients with a suite of integrated solutions designed to meet their end-to-end operating needs. Previously, Curey held senior operating and strategy positions at Automatic Data Processing from 2011-2019. Most recently, he was president of GlobalView HCM, serving ADP’s largest global clients in over 100 countries. He began his career as a consultant at McKinsey & Company.