New final rule for capital and stress testing applies to you.

The financial crisis or “Great Recession” of 2007–2008 led to such reforms as the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, which was designed to ensure future financial stability and reduce the systemic risk to our national economy from the failure of large banks.

These reforms were aimed at the critical deficiencies in the fundamental risk measurement and risk management practices necessary to assess the capital adequacy and internal capital planning processes within large banks. They included requirements for comprehensive stress testing, initially known as the Supervisory Capital Assessment Program and then the annual Comprehensive Capital Analysis and Review, as mandated by Dodd-Frank for certain financial institutions with more than $10 billion in assets.

While the largest banks are orders of magnitude larger than the largest credit unions; the on-balance sheet and off-balance sheet risks of banks and credit unions are very different; and the failure of large credit unions does not necessarily pose a threat to the national economy, failure of large credit unions still poses a systemic risk to the National Credit Union Share Insurance Fund, which provides more than 8 million members with at least $250,000 of insurance at a federally insured credit union.

Like the other federal regulators and as part of the movement toward greater supervisory transparency, the board of the National Credit Union Administration in April 2014 approved an initial capital planning and stress testing rule for the nation’s largest credit unions to set them up to survive the next crisis. These capital planning and stress-testing requirements were varied based on the size of credit unions and the potential risk they posed to NCUSIF. The intention was that after successfully passing three successive NCUA stress tests, credit unions would be able to run their own tests under NCUA guidance and subject to NCUA specifications and validation.

On April 20, 2018, the NCUA board unanimously approved a final rule to amend its regulations (12 CFR Part 702) regarding capital planning and stress testing for federally insured credit unions with $10 billion or more in assets.

Although designed to protect the NCUSIF against a future crisis from failure of federally insured credit unions with assets of at least $10 billion, which by their sheer size, pose the largest potential risk to the NCUSIF, the final rule also provides some much-needed regulatory relief by phasing in both the capital planning and stress testing requirements as credit unions grow.

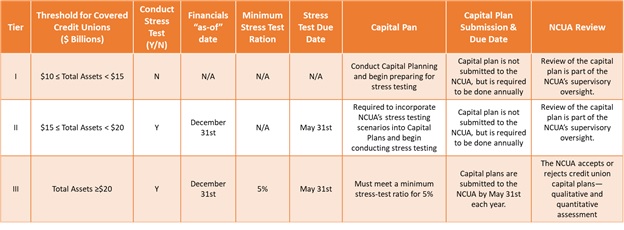

The final rule has three tiers of covered credit unions and imposes varying levels of regulatory requirements for both capital planning and stress testing based on those tiers, see Table 1, below.

- Tier I – A benefit of the tiered approach is that it allows a tier I credit union time after it reaches the $10 billion threshold (the level at which credit unions move from being supervised by our NCUA regions to the NCUA Office of National Examinations and Supervision) to obtain the policies and processes necessary to develop sound capital plans and analyses prior to incorporating supervisory stress testing. The capital plan does not have to be submitted to the NCUA, but must be done annually and will be reviewed as part of the regular NCUA supervisory oversight.

- Tier II - Once a covered credit union has $15 billion in total assets, it must start conducting stress testing and incorporate NCUA’s annual stress test scenarios into its capital plan, even though the capital plan is not required to be submitted to the NCUA on May 31 of each year (as in tier III) and again will be reviewed as part of the regular NCUA supervisory oversight.

- Tier III - Once a covered credit union has $20 billion in total assets, it is required to submit its capital plan to NCUA by May 31 of each year for formal approval or rejection by the agency. Tier III credit unions are also subject to supervisory stress testing requirements and must meet a minimum stress-test capital ratio of 5 percent (Stress test capital ratio means a covered credit union’s stress test capital divided by its total consolidated assets less NCUSIF deposit). These credit unions must incorporate the NCUA’s stress test scenarios into their capital plan submissions. Because tier III credit unions pose the greatest level of systemic risk to NCUSIF, they must also submit a plan to build capital or mitigate the risk if the credit union shows that its stress test capital ratio would fall below the 5 percent minimum stress test capital threshold.

Table 1: Summary of Final Rule Capital Plan & Stress Testing Requirements

The Stress Test

The final rule’s supervisory stress tests:

- consist of a baseline scenario and stress scenarios, which NCUA will provide by Feb. 28 of each year and will be primarily based on the credit union’s financial data as of Dec. 31 of the preceding calendar year;

- Tier III credit unions must apply the minimum stress test capital ratio of 5 percent to all time periods in the planning horizon;

- are required be conducted without assuming any risk mitigation actions on the part of the credit union, except those existing and identified as part of the credit union’s on-balance sheet or off-balance sheet positions, such as derivative positions, on the date of the stress test.

The stress tests must estimate the following for each scenario during each quarter of the planning horizon:

- losses, pre-provision net revenues, loan and lease loss provisions, and net income; and

- the potential impact on the stress test capital ratio, incorporating the effects of any capital action over the planning horizon and maintenance of an allowance for loan losses appropriate for credit exposures throughout the horizon.

The Timing

The final rule is effective June 1, 2018, after the May 31, 2018, submission date for capital plans. The current rule remains effective for covered credit unions’ 2018 capital plans and all covered credit unions must complete their capital plans by May 31, 2018. Tier I and II credit unions, however, do not need to submit their capital plans to the NCUA by May 31, 2018, and the NCUA will review their capital plans through the supervisory process. With respect to stress testing, NCUA will conduct stress tests in calendar year 2018 for supervisory purposes.

The final rule is effective June 1, 2018, after the May 31, 2018, submission date for capital plans. The current rule remains effective for covered credit unions’ 2018 capital plans and all covered credit unions must complete their capital plans by May 31, 2018. Tier I and II credit unions, however, do not need to submit their capital plans to the NCUA by May 31, 2018, and the NCUA will review their capital plans through the supervisory process. With respect to stress testing, NCUA will conduct stress tests in calendar year 2018 for supervisory purposes.

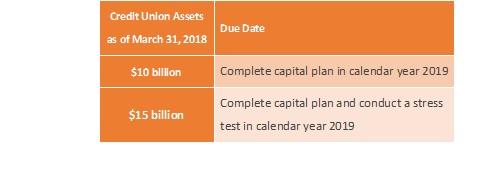

Moving forward, the final rule applies the asset thresholds as of the March 31 measurement date of each year. If a credit union crosses any of the tier I, II, or III asset thresholds by March 31, then the credit union’s new classification is effective at the beginning of the next year.

Conclusion

Risks that are identified and understood can be evaluated and, where appropriate, assumed with proper safeguards and effective capital planning. Risks that are overlooked, misunderstood or taken outside of a well-considered and comprehensive risk-management framework can sow the seeds for serious trouble for individual credit unions and potentially for the credit union system.

The final rule amendment to regulations (12 CFR Part 702) regarding capital planning and stress testing for federally insured credit unions with $10 billion or more in assets are based on the understanding that thorough, rigorous risk management must underpin all the activities of all systemically important credit unions to protect NCUSIF and thereby millions of hard-working Americans. It seeks to ensure not only that all large credit unions have strong capital positions as determined through the supervisory stress test, but also that they have strong capital planning practices appropriately focused on the capital needed to withstand possible losses from the specific risks in each firm's business model. The phased in approach provides credit unions runway to appropriate prepare for these requirements as they grow.

Are you ready?

So, are you a credit union with $10 billion in assets? If so, hopefully you are well on your way to developing your capital planning processes as you will be required to have a complete capital plan in 2019. As you think about your capital planning processes, it is never too early to start thinking about stress testing, what data you will need to capture and how it will fit into your overall process. If you are not at $10 billion yet, do not wait till you are at $9 billion before you start thinking about the capital planning process and especially the data you will need which will also help you with other risk management activities as you grow.

Amar Saini is managing principal of HnC Smart Solutions.