5 minutes

5 steps to exceeding regulatory expectations and creating more flexibility in your balance sheet

Loan growth has outpaced deposit growth over the past few years and on-balance sheet liquidity levels have been declining. Wholesale funding levels are on the rise and deposit attrition levels continue to increase. Undeniably, liquidity is under pressure and regulators are taking notice. Now is a good time to take your liquidity process to the next level.

Based on experiences gleaned from working with credit unions throughout the country as well as valuable interaction with the National Credit Union Administration, we have identified solid ways to improve your liquidity process to help exceed regulatory expectations and, more importantly, give your credit union more flexibility in managing the balance sheet to improve margin.

Follow these five steps to develop a stronger, more strategically focused liquidity process:

1. Identify Your Liquid Asset Cushion

Shifting cash and security cash flow into loans can be a fruitful strategy to protect and increase margin when rates are low. However, doing so can inadvertently trigger a regulatory concern. Management teams must identify what liquid asset “cushion” is appropriate for their business model and risk appetite (a recent focus in many exams). This cushion will depend on a number of factors.

Before defining the cushion, we must determine how we define liquid assets. Is it being calculated by looking at Cash plus Short-Term Investments or Cash plus Unencumbered Security Collateral? The first approach focuses more on cash and near-term cash flow; the other focuses more on a collateral-based approach.

At Darling Consulting Group, we focus on the latter. Less focus on having to hold cash—and more on secured-collateral such as bonds from a government-sponsored entity. Think of the liquidity difference of a Government National Mortgage Association bond vs. a one-year investment CD. A GNMA or “Ginnie Mae” bond provides collateral on the market value day one, while a one-year investment CD provides little collateral value and the liquidity is available only upon maturity or if redeemed early.

An appropriate liquid asset cushion can be determined once the methodology has been established. So, how do you determine the right cushion for your credit union?

First, review how well your liquidity position fares under various stress levels. If liquidity levels are under pressure during a “mild” stress event, you may lean towards holding more on-balance sheet liquidity.

Second, review the strength of your total liquidity position. If your credit union has a comfortable amount of available loan collateral at the Federal Home Loan Bank and established/tested funding lines, you may feel more apt to run liquid assets a bit tighter (more on this in section 2).

The liquid asset discussion not only has regulatory implications, but also such strategic implications as:

- How do we plan on funding loan growth over the next 90 days?

- How aggressive do we need to be with deposit pricing?

- What is our strategy for redeployment of excess cash and upcoming bond cash flow?

- What are our comfort levels with wholesale funding?

2. Focus on Total Liquidity

Liquid assets are just one component of a liquidity analysis. Credit unions must look at the total liquidity picture inclusive of available collateral established at the FHLB, non-member deposit availability and other funding lines (e.g. Federal Reserve, corporate credit union lines, etc.). Take inventory of available liquidity at each level and determine your comfort level (i.e. policy) for each.

It is important to discuss with your asset/liability committee at this stage your comfort levels with wholesale funding, as we find that in some instances there may be internal pushback. Interestingly, larger credit unions (>$500 million in assets) often have higher levels of wholesale funding and higher loan/share ratios than smaller credit unions. We have found it helpful in ALCO meetings to openly discuss the benefits of wholesale funding (e.g. marginal cost of funding discussion), as well as get any concerns out in the open.

3. Revisit Your Contingency Funding Plan

A focus of regulatory feedback recently has been on the shortcomings of a credit union’s contingency funding plan. A well-structured CFP should identify early warning indicators that can “trigger” potential liquidity stress, assess the risk severity and establish a response plan to preempt a liquidity crisis. For example, how would the credit union react if funding lines were shut off and there were a “run” on deposits? If one option is to reallocate collateral to the Federal Reserve, be sure that this funding source is documented within the policy and is tested at least annually.

4. Build a Robust Stress-Testing Framework

Step 1 is to build out a dynamic liquidity forecast—the timing is perfect as you can incorporate your 2020 budget into your liquidity plan. Be sure to complement the projected cash surplus/deficit with all of your alternative funding lines to understand how potential funding gaps can be supported.

Step 2 is to build out the stress tests. This doesn’t have to be overcomplicated. A blend of macro-level and credit union-specific stress tests should suffice. Be sure to elevate the level of stress in multiple scenarios with assumptions that make sense for your risk profile and business model. Eventually you will build a scenario in which you fall below well-capitalized. Tell the story for each stress test (i.e. what stress environment are we trying to emulate?). We have found the following key assumptions should be included in your stress testing process:

- Deposit runoff (refer to your credit union’s recent deposit study)

- Reduced/removed funding lines

- Increased utilization of lines of credit

5. Develop a Risk Monitor

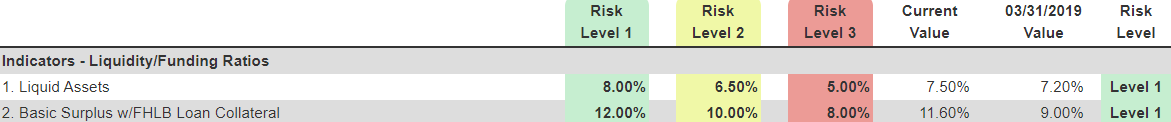

The entire focus of a CFP is to identify a liquidity problem before it arises. We have found that a risk monitoring system allows credit unions to avoid having too many liquidity policies while still having a platform to track liquidity threats through a robust set of early warning indicators. Determine risk levels that are commensurate with your credit union’s risk tolerance.

Track credit union-specific EWIs (e.g. liquid assets) and develop trigger levels that act as a warning system to detect a liquidity issue before it arises. Furthermore, provide insight to all stakeholders on indicators that have been triggered, the level of stress it causes the credit union and action items if necessary.

Exhibit 1: Sample Risk Monitor

Liquidity levels are tightening in our industry and regulators are taking notice. Building a robust liquidity management platform will provide a level of comfort to the regulators and, more importantly, provide key strategic information in managing the balance sheet to improve margin.

As managing director of Darling Consulting Group, Newburyport, Massachusetts, Joe Kennerson works directly with credit unions in improving their overall asset/liability management processes with a specific focus on liquidity management. Darling Consulting Group’s Advisory service and Liquidity360°® online contingency liquidity tool have helped hundreds of ALCOs take their liquidity management process to the next level. Reach Kennerson at 978.463.0400 ext. 150.