3 minutes

Lessons from the Great Recession

It is safe to say that for most of us, the COVID-19 global pandemic is unprecedented and was unexpected. However, while the pandemic itself may have been a new and different type of crisis, the resulting economic downturn is not uncharted territory, including for financial institutions.

Throughout history, times of economic uncertainty and contraction have spurred mass layoffs, cancellation of capital expenditures and organizational “tightening of the belt.” Though this has been the common response, is it the correct response for financial institutions? A thorough analysis of data from the Great Recession and other recessionary periods is clear: The best way to emerge from a recession stronger is not to solely enact cost cutting measures, but to wisely balance cost reduction efforts with strategic investments in the future.

How organizations cut costs also matters. Our research found that, generally, organizations that cut costs by maximizing operational efficiency, as opposed to cutting employees, weathered the recession and performed better coming out of it than those that significantly cut their workforce. Additionally, these organizations seized opportunities to invest in business growth through research and development, and property and equipment investments, as well as other capital expenditures.

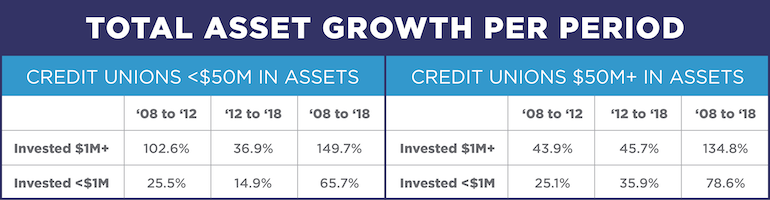

While these business practices are relevant across industries, they are certainly true within the financial services industry. As expected, the larger the credit union, the greater its chance of survival; however, data also shows that investments in fixed assets (land, buildings, etc.) positively impacted survival rates for organizations of all sizes. More than just surviving, credit unions that invested in fixed assets thrived, seeing increases in assets and new memberships both during and after the recession.

For credit unions, especially those that have already embraced the digital age, there aren’t many ways to dramatically increase efficiencies to reduce cost and invest in the future simultaneously. However, those few existing areas of opportunity lie in both the physical footprint and digital platforms.

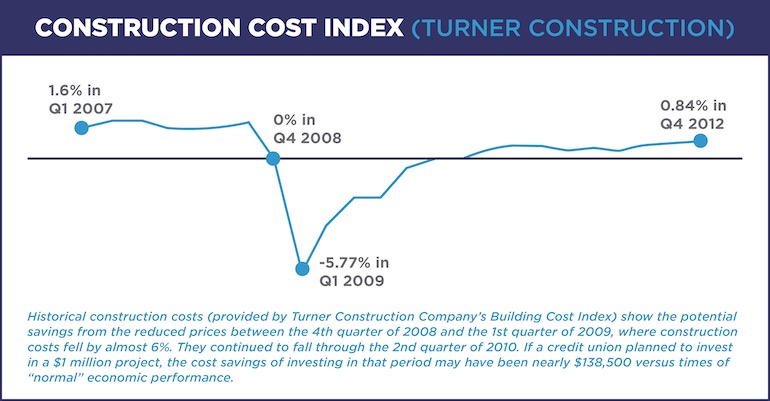

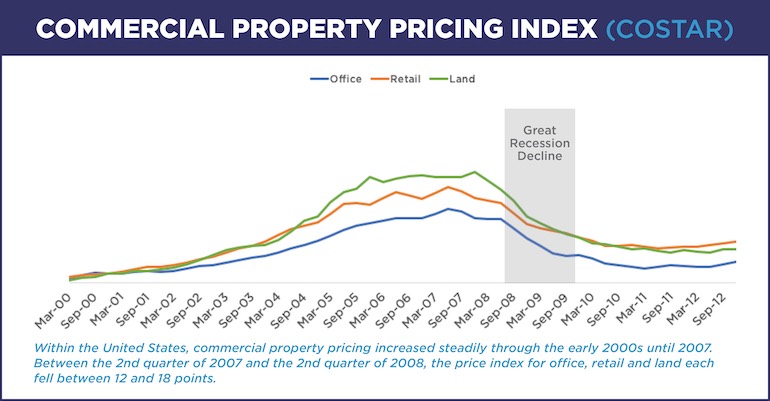

While data shows that updating, repositioning or even adding new branches can provide an opportunity to reduce costs and more deeply engage consumers, there is added benefit to making these investments during a time of economic contraction, because it may cost less to do so. During times of recession, construction and commercial real estate costs decrease. This can present a unique window of opportunity for savvy organizations.

But investment in brick-and-mortar must not be done in a vacuum; it must be done in coordination with a digital strategy. Gone are the days when investing in digital meant not investing in other, traditional channels, or only supporting online and mobile banking. Rather, as a platform that supports self-service and remote-service, investments in digital delivery can help to scale customer service improvements across the board.

The COVID-19 pandemic has further illustrated the need for a cohesive user experience that includes both in-person and digital/virtual banking options. Financial institutions that have already made investments in technology have not only better weathered the current pandemic but will be better positioned to welcome members back to their physical branches—they’ll have maintained member engagement, and by strategically shifting employee roles, including to remote work, they’ll have retained their valuable and knowledgeable workforce.

When carefully executed based on a critical understanding of target demographics, socioeconomic and behavioral profiles for the institution, investments in physical branches and technology in the midst of a recession can ensure a financial institution not only survives an economic downturn, but thrives.

Benjamin La Macchia is senior vice president at La Macchia Group, Milwaukee, Wisconsin, a design-build-brand firm and trusted partner of hundreds of financial institutions across the nation. Ben serves as the in-house real estate expert and site development coordinator. Click here to download La Macchia Group’s whitepaper: "Opportunity in Uncertain Times."