2 minutes

How much are you willing to pay to be chummy with your solution providers?

This article was original printed on the GonzoBanker blog and is reprinted with permission.

In a recent survey of banks and credit unions about their technology vendor contracts, Cornerstone Advisors found that more than half of these financial institutions allow emotional factors to influence their negotiation processes. And it’s costing them money.

We’ve negotiated enough contracts to understand why this happens. Sometimes an FI shares mutual admiration and trust with its vendor rep. Or maybe the vendor delivered a truly useful product and provides stellar service, and the institution does not want to jeopardize that relationship. The reality is, positive experiences do not have to equal free passes for the vendor.

Technology Vendor Financials Tell the Story

We’ve seen how vendors bemoan the scrutiny on their publicly traded stock as a reason to hold firm on pricing or complain that they can’t afford to negotiate price due to their high commitment to research and development. Bankers, there’s no need to feel sorry for the technology vendors that serve your market. They’re doing just fine.

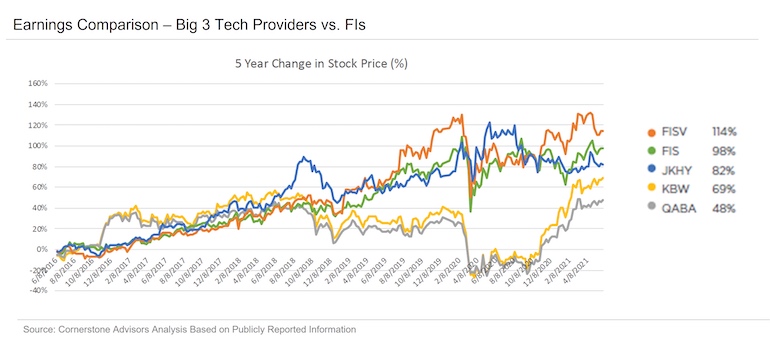

A comparison of the five-year stock performance of the Big 3 financial technology firms (FIS, Fiserv, and Jack Henry) to the KBW and QABA indices (both benchmark stock indices of the banking sector) illustrates that the Big 3 have been delivering much higher and more stable stock price growth than banks—by a significant margin. Financial institutions should think about this before deciding to let contract pricing go unnegotiated.

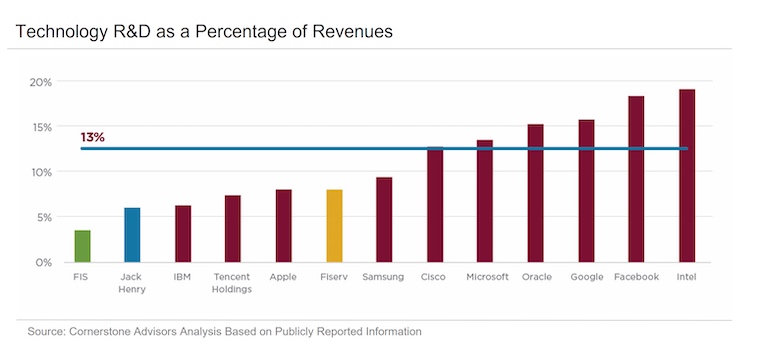

A comparison of the relative amount of R&D spending at Big 3 versus other well-known technology providers paints a frightening picture for financial institutions that are relying on Big 3 vendors to steer their technology innovation.

A word of advice for credit unions: Next time you’re thinking about allowing a contract to auto-renew or sign a contract without price discussions, remember how the Big 3’s stocks are outperforming bank stocks and how the vendors are under-investing in R&D.

This post is excerpted from “Seizing the Upper Hand in Contract Negotiations,” a new white paper from Cornerstone Advisors. Download it here.

GonzoBanker is the “alter ego” of CUES strategic partner Cornerstone Advisors. It is an online information resource dispatched weekly along with a good helping of irreverence to tens of thousands of readers around the world, including banks, credit unions, trade groups, the media and industry analysts.