3 minutes

How the pandemic affected allowance levels under CECL and incurred loss models

In 2020, most Securities and Exchange Commission-filing institutions were required to move to the new current expected credit loss, or CECL, model. Following the 2007-2008 financial crisis, the CECL model aimed to provide more timely adjustments of reserve levels than the existing incurred loss method. Unlike the incurred loss model, the CECL model is forward-looking, estimating loans’ lifetime losses using reasonable and supportable forecasts.

Most financial institutions adopting CECL in 2020 had braced for their reserves to increase—even before the pandemic. But while COVID-19 created an entirely new, unforeseen challenge to estimating reserves for all financial institutions, it also reinforced the philosophy behind the new accounting standard.

Abrigo analyzed proprietary loan-level data from financial institutions operating under the two different models and found contrasting stories of how reserve and provision levels progressed after the pandemic began. Neekis Hammond, managing director of advisory services at Abrigo, presented these findings during a recent presentation at ThinkBIG 2021.

How the Pandemic Affected the Allowance Under CECL

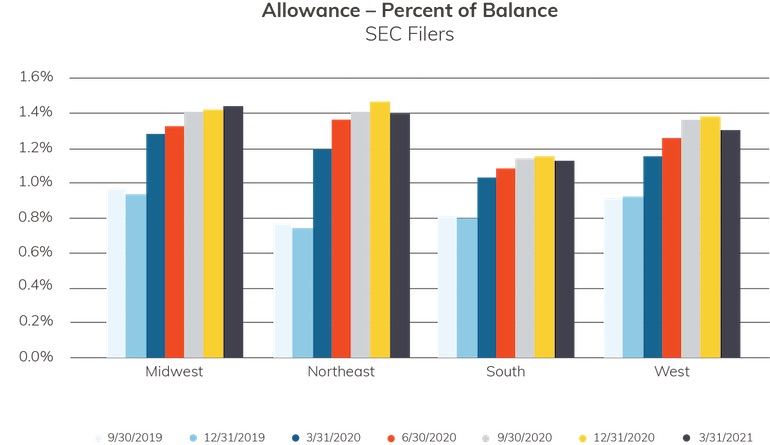

SEC-filing financial institutions were still operating under the incurred loss model throughout 2019, with very few changes to their allowance levels. Three months later, however, allowance levels jumped significantly. Let’s think back to Q1 2020. First, SEC-filing financial institutions began reporting under the CECL standard—an expected change. In February, the U.S. declared a public health emergency, and COVID-19 became a global pandemic in March. Shortly after that, COVID-19 was declared a national emergency, sparking stay-at-home orders and other mandates.

Economic forecasts became extremely volatile, and unemployment rates spiked to 14.7% in April—the highest rate since the Great Depression. Historic unemployment, coupled with historic government intervention, made forecasting particularly challenging, and financial institutions had to incorporate qualitative adjustments for a “reasonable and supportable” forecast.

By the end of Q2 2020, allowance levels began leveling off, although many financial institutions were still wary of deferments in place and concerned that losses might be delayed rather than mitigated. For most financial institutions, allowance levels peaked in Q4 2020, and as conditions and the economic outlook continued to improve, releases began taking place.

Contrasting the Allowance Under the Incurred Loss Model

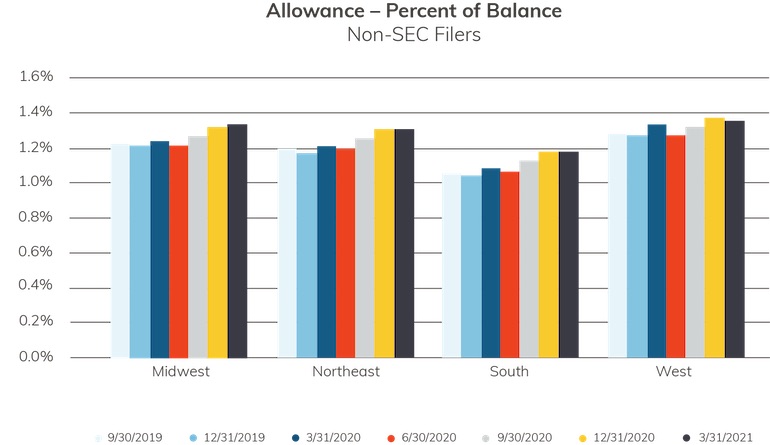

Smaller, non-SEC filers operating under the incurred loss model tell a very different story. General trends in allowance levels show a progressive upward curve, peaking in Q1 2021. Despite the pandemic and historically high unemployment rates, allowance levels reported in March and June 2020 almost mirror those of 2019 numbers. In fact, allowance levels really didn’t begin ramping up until Q3 and Q4 2020, showing a significant lag in response.

"We wanted a standard that would mathematically justify increasing reserves for future uncertainty,” Hammond said. “Looking back at these two data sets and contrasting between them, it’s playing out.”

Likewise, releasing reserves when conditions improve is playing out as well, but not in the incurred loss space. The contrast in both allowance levels and provisions between institutions operating under the CECL model versus those operating under the incurred loss model demonstrates the central driver of FASB’s action toward CECL: recognize and prepare for losses more quickly.

Preparing for 2023

Moving forward, SEC filers that have adopted the CECL standard will focus on preparing internal stakeholders for upcoming releases and longer-term forecast views.

“For the SEC-filing institutions that have adopted CECL, the preparation that you can do is model as if you are in 2022 or 2023 and see those long-term release trends. That’s a luxury that the CECL folks have when these models are quantitative in nature—you can model as if you are in future periods,” Hammond explained.

Financial institutions operating under the incurred loss method have traditionally relied on qualitative factors for calculating their reserves and will need to prepare for the quantitative side of CECL. Of course, as COVID-19 demonstrated, qualitative factors will not go away, and it is important for institutions understand when adjustments are needed and how to document them. With just a year and a half left before the 2023 effective date, time is ticking. Make sure your financial institution stays diligent and committed to its implementation timeline.

Kylee Wooten is media relations manager for Abrigo, Austin, Texas, a software company that offers technology that banks and credit unions use to manage risk and drive growth.