5 minutes

Find success by refreshing your compensation philosophy and building out your executive compensation toolbox.

Sponsored by Aon

The Great Resignation has caused severe retention issues at many firms at every level. Voluntary turnover was up 41% in 2022 and up to two-thirds of workers are looking for a new job. While the labor market showed signs of cooling in 2023, retaining and motivating your top executives is important in any economic climate or cycle. Organizations are implementing defensive strategies to lock in their high-performing executive teams.

Compensation Philosophy Refresh

The first step to determining which tools to consider is understanding what you are trying to accomplish with your compensation programs. The purpose of a compensation philosophy is to help provide a framework for compensation decision-making. However, the clichés associated with a standard compensation philosophy (“attract, retain and motivate”) typically do not provide an actionable framework foundation for the board of directors when setting CEO and executive compensation or for human resources when designing salary structures and incentive plans.

If your approach to pay is so broad that it doesn’t support decision-making or guide strategy, what is its benefit? To bring actionable specificity to your philosophy, we recommend having answers to the following two key questions:

1. Who are your biggest competitors for talent? When setting compensation, it is essential to understand who your biggest competitors for talent are. To explore this question further, ask yourself: (1) From where have we sourced our recent hires? (2) To whom are we losing talent? We often hear that credit unions’ biggest competitors are credit unions and banks. Because of this, credit unions must maintain a strong understanding of pay in both industries.

2. How does your credit union want to compare? Once a competitive market is defined, we recommend specifying how your credit union will ideally compare to that market. At the most basic level, credit unions should determine whether their strategy will focus on meeting, leading, or lagging the market. While many organizations choose to meet the market, commonly defined as the 50th percentile, some firms target the 55th, 60th, or even the 75th percentile due to ambitious growth plans, high expectations or workloads and/or the desire to be seen as an employer of choice with competitive pay opportunities. Compensation philosophy decisions should be unique to each credit union’s goals and values.

Executive Compensation Toolbox

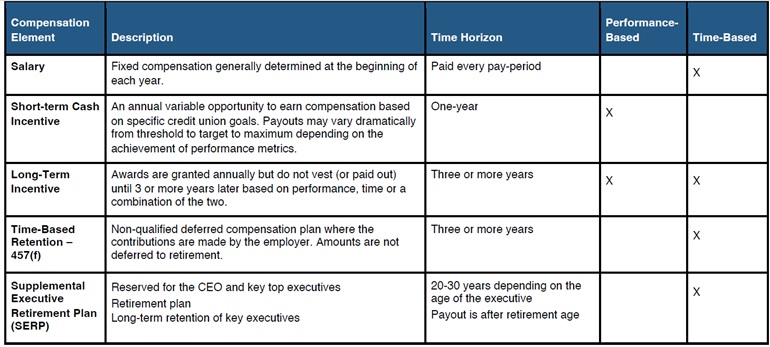

Once the compensation philosophy is known, it becomes easier to decide which tools to utilize and which to emphasize. The following table outlines the primary building blocks available to building a successful compensation package for executives.

There are two key questions to ask when considering how to utilize the toolbox:

1. Which tools should we use? Almost all credit unions utilize salaries to assist with attracting executives and short-term cash incentives to align executive compensation with annual performance. Credit unions have historically utilizes time-based vehicles for longer time horizons as well. Time-based retention vehicles often referred to as 457(f) plans as well as supplemental executive retirement plans (also known as SERPs) have been staples in the credit union compensation toolbox.

SERPs or retention awards are still viable options for the CEO and select key executives. Using an independent advisor can help you decide what is market practice for eligibly as well as benefit size and the most efficient options for funding the retirement plan.

Long-term incentives are another option that has been gaining traction with boards. There are four primary reasons for this growth:

- Performance-Based Pay. A pronounced trend over the last decade is toward more performance-based compensation for all levels in the organization at both banks and credit unions. For executives this has developed into increased prevalence of performance-based LTIs (either partially or fully performance-based).

- Credit Union Size: Credit unions have grown such that competition with banks is fiercer, and more credit unions have reached the size where LTIs are common in the broader market. In 2000, there were 53 credit unions above $1billion in assets; in 2022 there were 428.

- Risk Mitigation. Regulators favor incentive arrangements that balance risk and financial results in a manner that does not encourage employees to expose their organizations to imprudent risk. Well-designed incentive plans mitigate risk by balancing annual and long-term performance metrics within their plans, i.e., three years or more for LTI plans. Long-term metrics better align executive pay with the mission of the credit union and the long-term interests of members, while also ensuring that executives have a balanced perspective of risk and reward.

- Excise Tax. The Tax Cut and Jobs Act of 2017 introduced a 21% excise tax for credit unions on any executive pay more than $1 million annually. 457(f) plans are typically time-based awards that vest in large tranches. The lumpy nature of the vesting makes them tax inefficient under the new tax law.

2. Which tools should we emphasize? Evaluating the overall pay mix of all compensation elements including consideration for performance-based pay and long-term results is critical to an effective executive retention strategy. Do we want to have an emphasis on performance-based pay? Do we want to emphasize short-term results more than long-term results? Once your credit union had decided which compensation tools to utilize, the question turns to plan design which typically involves partnering with an outside expert to assist the Compensation Committee with market best practices and communication tools for the executive leaders.

When building an effective executive compensation package, understand your credit union’s competitors for talent, how you want to compare to the competition, what tools are available and what tools to emphasize. All these decisions should be made with a solid understanding of the market.

Katrina Gerenz is partner, Chris Richter is associate partner and Ryan Gildner is director of CUES Supplier member Aon. Aon’s human capital business provides leaders with a powerful mix of data, analytics and advice to help them make better workforce decisions. Our team, spanning 2,000 colleagues in more than 30 countries, includes the firm's rewards, talent assessment, and performance & analytics practices. Aon plc exists to shape decisions for the better—to protect and enrich the lives of people around the world. Our colleagues provide our clients in over 120 countries with advice and solutions that give them the clarity and confidence to make better decisions to protect and grow their business.

This article provides general information for reference purposes only. Readers should not use this article as a replacement for legal, tax, accounting or consulting advice that is specific to the facts and circumstances of their business. We encourage readers to consult with appropriate advisors before acting on any of the information contained in this article.

The contents of this article may not be reused, reprinted or redistributed without the expressed written consent of Aon. To use information in this article, please write to our team.

© 2022 Aon plc. All rights reserved.