3 minutes

It’s the secret source to delight members with slick workflows and a personalized approach.

Sponsored by Creatio

As customer preferences evolve rapidly with technology and market saturation intensifies, credit unions face a future driven by digital transformation. However, many credit unions have not yet integrated advanced business technology capable of meeting their members’ automation needs, risking their market share to tech-savvy competitors.

Traditionally, credit unions rely on their core systems designed for routine transactions. While these systems adequately support basic operations, their limited customization and scalability can hinder credit unions from achieving the necessary agility and adaptability for a comprehensive transformation.

Today’s members seek digital, engaging, high-quality experiences that enable seamless interactions across multiple touch points within a single transaction. Although the need for swift transformation is evident, credit unions often grapple with limited IT resources and tight technology budgets, a common scenario for non-profit organizations.

To address these challenges, credit unions require innovative solutions that streamline workflows, foster team and member interactions, and circumvent the need for additional IT staff and significant investments.

Enter the Era of No-Code Architecture

To prioritize members and their experiences, credit unions must cultivate an environment that is seamless and personalized. This goal can be achieved through no-code platforms, empowering business users, even those without a technical background, to develop digital solutions and digitize their processes independently.

No-code, a forward-thinking approach to software application development, requires no coding, enabling users to build business applications, digital workflows and UI/UX pages through visual drag-and-drop tools. With such an approach, the complex development process turns into an assembly effort, where business technologists alongside IT can safely assemble a needed application from available components (“building blocks”).

Credit unions stand to be one of the significant beneficiaries of no-code composable architecture software, integrating easily with their legacy systems and enhancing their existing ecosystem with modern, user-friendly and agile tools.

No-code allows credit unions to increase time-to-market and deploy modern member-centric automation to efficiently compete with larger players holding big IT budgets.

Possible Applications

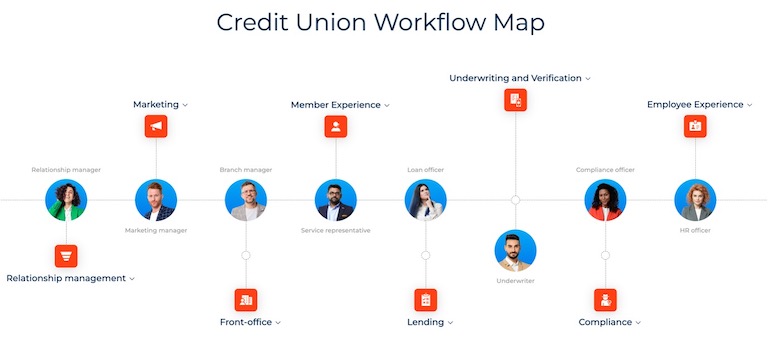

The most frequently asked question about this is what exactly can be automated with modern no-code tools. Well, the options are wide open. Here is a quick illustration of possible use cases that can be deployed via no-code solutions.

No-code platforms can help credit unions to automate member experience, increase the efficiency of member interactions through personalized consultations and offers, streamline case management processes, and digitize lending, member onboarding and compliance workflows. Modern platforms usually include robust application programming interfaces and ready-made connectors that can be used to achieve integration with the existing IT ecosystem.

Future-Ready Credit Unions

The no-code approach can enable credit unions to rethink their strategy of automation and significantly increase capacity and speed of change. It also encourages the alignment of business and IT functions to work together more closely. As with any new technology, it requires time for adoption; however, once the needed skills are in place, it can become a secret sauce for the ones who are ready to bring innovations and build resilience for years to come.

As chief growth officer at Creatio, Andie Dovgan is responsible for the company's global marketing organization, business development, sales enablement, and sales engineering teams with the full focus on growing the brand and lead generation, as well as providing strong support for all expansion initiatives across the globe. A CUES Supplier member based in Boston, Creatio is a leading provider of no-code workflow automation. The company is focused on the market of credit unions and regional banks and works with a number of prominent credit unions, including Ent, Consumers Credit Union and Honor Credit Union.