5 minutes

Thinking about how your credit union would weather an economic storm is helpful, whether the turndown arrives now or later.

The news is full of predictions that a recession is coming. The truth is that a recession is always coming–eventually. Whether you believe it’s imminent or more distant, it’s important to think through how your institution might weather the storm, and whether adjustments should be made to prepare for a tougher economic reality.

Visualize

Planning for uncertainty is best done as a team so a variety of views are tapped. Rather than going straight to the numbers, paint a picture of the recession to get everyone engaged. Create a story to help people visualize what could happen, so they can contribute in a meaningful way. Your story could start with describing what will trigger the next recession and include the effects on local employers and the local economy. Describe how different groups of members would be affected and how their behaviors would change as a result.

What could be different this time?

Many remember the Great Recession vividly, but rather than letting that drive your scenario, challenge each other to think deeply about what could be different this time. A few areas to start with are net interest margin and provision for loan loss.

Loan demand and rates both experienced steep declines as a result of the Great Recession. Loan income took a big hit, but according to data from Callahan & Associates, cost of funds for the industry also dropped 186 basis points (bps) over a span of 3 years. The net interest margin actually went up during that time. With cost of funds at 73 bps as of third quarter 2018, there isn’t room for that kind of relief today. Consider how this factors into your recession picture.

Provision for loan loss peaked at 1.07 percent in December 2009. Loan losses were a major factor during and after the Great Recession. In determining whether credit risk will be different this time, a good question to ask is how leveraged your members are. The Federal Reserve Bank of New York recently showed that household debt in the fourth quarter of 2018 is now higher than the previous peak in the third quarter of 2008 ($13.5 trillion vs. $12.7 trillion). At the same time, the Federal Reserve Bank of St. Louis shows that debt payments as a percentage of disposable personal income have never been lower (data collection started in 1980).

Harness the Power of Testing in Advance

Once your recession story is created, how concerned should you be? Before worrying too much, use the power of seeing what could happen in advance by modeling what-ifs.

Determine which areas are high-impact and test those to help focus your team’s thinking and discussions.

What Levers Can Be Pulled?

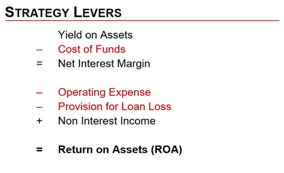

Now that the effects of your recession scenario are clearer, it’s time to decide how the institution could respond. Which of the five strategy levers do you have the most control over, and what, specifically, would you be willing to do to offset the effects of a recession?

A common lever to target is operating expense, since this is the lever that’s easiest to control. Cutting expenses can also hurt the business model, so protecting the ability to deliver the value proposition should be front of mind. Remember that operating expense ratios are 21 bps lower as of third quarter 2018 than they were going into the Great Recession, so there may not be as much room to adjust as there was last time.

What Levers Should be Pulled Today?

As recession responses are identified, step back to think through which should be implemented before a recession occurs. This is key, and one of the beneficial outcomes of recession planning. The realization hits home that such responses as building efficiencies or shedding unprofitable products will not hurt today and will help prepare the institution to thrive through the next recession. This preparation can give new urgency to ideas that have been on the back burner for a while.

Preparing for a recession doesn’t mean you’ll have an accurate prediction of what will happen, but it can put you and your members on firmer ground as you face an uncertain future.

Keep it Simple and Effective

In reasoning through how a recession could affect your institution, the severity, length and characteristics of the downturn will make a difference. One approach is to consider a recession that you believe is likely and one that is severe. Then run what-ifs to model both versions, use the likely version as a basis for planning, and view the severe version as more of a survivability test. Combine relevant what-ifs to show an overall picture. Make sure the time frame of your view is long enough since the effects of a recession, especially slow loan growth, will be felt for longer than a year. Finally, less is more. With so many factors to consider, strive to keep your analysis as simple as possible by focusing on the biggest impacts.

c. myers corporation has partnered with credit unions since 1991. The company’s philosophy is based on helping clients ask the right, and often tough, questions in order to create a solid foundation that links strategy and desired financial performance. c myers has the experience of working with over 550 credit unions, including 50 percent of those over $1 billion in assets and about 25 percent over $100 million. They help credit unions think to differentiate and drive better decisions through real-time ALM decision information, CECL consulting, financial forecasting andconsulting, liquidity services, strategic planning, strategic leadership development, process improvement, and project management.