5 minutes

Focus on problem-solving for your key stakeholders

Portions of this article are excerpted from George’s recent book, Banking on a Human Scale.

Every credit union has a similar origin story: in 19XX, a group of {insert a common bond group} became frustrated with their lack of access to affordable financial services. So {insert number of founders} from {insert common bond group} decided to throw $ {insert initial capital, likely less than $1,000} into {insert a physical vessel like a cigar box} to solve this need. Today, XYZ Credit Union is a multi- {million or billion} full-service financial institution.

Throughout history, we’ve chartered a lot of credit unions. In 1969, we peaked with a total of 23,866 active credit unions. As of June 2023, only 4,686 credit unions were operating: a 21% survival rate. If credit unions want to not only survive but thrive, they need to (among other things) develop their strategic thinking muscles. This mandate is both individual and organizational. In this column, I hope to share successful approaches with the 50 or so clients I have the privilege to work with in today’s credit union landscape.

During credit unions’ founding years, the line of sight on the problems they were trying to solve was close and very direct. For instance, Jim and Mary were on the shop floor of their single sponsor credit union and they could physically walk over to the volunteer board member who was also on the shop floor and commiserate about their financial needs and problems. For today’s “surviving” credit unions that line is much more indirect and a lot further away. It’s logical: as credit unions grow, they serve more members (likely) outside the original field of membership, technology takes you away from the traditional face-to-face interactions you grew up on, and the regulatory environment tightens and loosens depending on the public policy environment.

Strategy is a simple concept: coming up with a logical and cohesive plan to meet new and/or novel needs in new and/or novel ways. So, how do credit unions continue to understand these needs in today’s environment? The answer: focus on problem-solving for your key stakeholders through strategic thinking. For the rest of this column, I share three particularly effective approaches.

Talk to People

We can’t recreate the past, but we can emulate it. One particularly low-cost and low-impact approach is to simply talk to people. Something we regularly did back in 19XX. When was the last time you went “into the field” and talked to people about the credit union in a largely unstructured manner? For many credit unions I work with the answer is “Jeez, not enough.”

With this approach, I’m not talking about a well-designed focus group with a consultant (though there is always a place for this tactic). Rather I’m proposing a more organic, open-ended conversation with key stakeholders. These stakeholder groups are not just core members, but also non-members, employees, volunteers, community members/leaders and potential competitors. This strategic thinking approach will yield a multitude of raw insights and ideas that your team to dig into.

Engage All Kinds of Weirdos

Keith Sawyer, a former video game designer and a current professor of psychology at the University of North Carolina-Chapel Hill, has written and spoken widely about the creative and strategic process. Sawyer hits at the fallacy that innovation or strategy is the work of a lone genius. He states in a relatively recent lecture, “It’s [creativity] not about one person generating a creative product. Today, it’s about groups of people coming together and doing things greater than any one person can do.”

Another thinker in this space created a vibrant and practical model that credit unions will find useful in determining who sits at the strategy table. Edward de Bono, an author, medical doctor, professor, game inventor, consultant and entrepreneur wrote a book called The Six Thinking Hats. It’s quite a read, but here’s the punchline: Get these six kinds of people at the table and your strategic decisions/outcomes will be much better:

- The White Hat is a neutral and objective player only concerned with facts, figures and data.

- The Red Hat is a from-the-gut person who leans heavily on emotions.

- The Black Hat is the devil’s advocate who is always cautious and ready to point out what could go wrong.

- The Yellow Hat is optimism incarnate, someone who seeks out the positive in any situation.

- The Green Hat is creativity unbounded, an individual who explores new and novel concepts unfettered from most peoples’ frame of thinking.

- The Blue Hat is all about process and ensures the other five hats are playing their assigned roles.

You will likely find that these personalities reside in your credit union, and, at times, it might be helpful to engage a “weirdo” from outside your circle to generate different perspectives and concepts. This democratic approach to strategic thinking may help you make sense of the insights gathered in the “talk to people” phase.

Forced Choices

A final strategic thinking approach encourages you and your team to make a ‘forced choice’ around the array of strategic options at your disposal. From the previous two approaches (and many others) you’ll likely yield many strategic opportunities, but it is unlikely you can address all of them. That is why one of the greatest strategy thinkers of our time, Michael Porter famously said, “The essence of strategy is choosing what not to do.” So, once you’ve addressed the table stakes and ‘boring stuff’ (e.g. operational efficiency, service delivery, pricing, etc.) of running a financial institution (not an insignificant task!), put your strategy through a forced choice exercise.

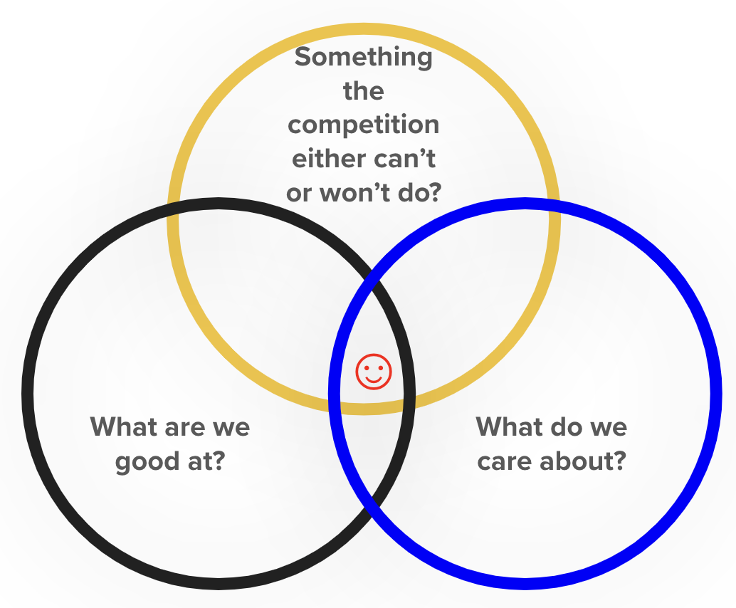

My favorite is a mash-up of a bunch of thinkers (notably Jim Collins in Good to Great) which asks your organization to find the bright spot in a Venn diagram I call ‘The Happy Place.’ It looks simple, but it can result in breakthrough thinking for your organization:

Many items can sit in one or two of the overlapping circles, but precious few will sit in the proverbial happy place. Seek this unique space out for your organization.

Conclusion

As stated earlier, my definition of strategy is: coming up with a logical and cohesive plan to meet new and/or novel needs in new and/or novel ways.

I hope that this brief article provides a few low-cost tools you and your team can use to ensure you are one of the survivors in our consolidating industry.

George Hofheimer is the founder of Hofheimer Strategy Advisors. He has 25 years of experience advising the consumer finance industry. He was the head of research and development at Filene Research Institute, the credit union industry's think tank for 15 years. Previously he was the chief learning officer at CUES, the credit union industry’s leading executive education association for eight years. Hofheimer has conducted hundreds of advisory engagements with consumer finance organizations across the globe and authored dozens of research reports, including a book entitled Banking on a Human Scale.