5 minutes

Enhance your CU’s board governance processes with the right tool.

For credit unions of all sizes, strong governance practices are fundamental for building and sustaining long-term success. Robust governance processes and practices help your organization foster transparency and accountability, ultimately gaining the trust of prospective customers and current members. More credit unions are using software to enhance their governance processes including board governance. Board management software can be used by both executive leadership teams and the board of directors to help manage corporate governance risk.

From supporting compliance to decision-making, see how board management software offers several benefits for credit unions seeking to lead with good governance.

Benefit #1: Streamline Compliance and Risk Management

Board management software can help simplify and automate governance processes to help ensure compliance with regulations as well as internal policies. For example, Aprio’s board portal software can help streamline policy approvals, document reviews and compliance assessments with features such as e-signatures, annotations and customizable surveys.

Board governance management software also provides an easy-to-access centralized repository for storing and managing company information including compliance-related documents such as regulations, policies and procedures, as well as financial or entity management documents. It can also be used to control document access and provide version control.

Benefit #2: Drive Accountability and Transparency

Credit unions use board governance software to help hold the board and executive leadership accountable and provide transparency in their operations.

Take activity logs, for example. Board software can automatically record every action taken within the system, including tracking by IP address, including logins, downloads, approvals and other activities. This transparent record of activities makes it easier to track board decisions and hold individuals accountable for their actions.

Board management software also supports accountability by supporting task management. Administrators can assign specific tasks or action items to a committee or individual, along with adding a due date and priority level. It not only holds individuals or groups accountable but also reduces the time and effort for administrators to ensure task completion with the help of notifications and reminders.

Benefit #3: Boost Board Meeting Productivity

Board meeting software supports effective time management during meetings. When creating an agenda, administrators can allocate time slots for each topic and assign a presenter. This ensures that important topics are adequately addressed in a timely manner, without unnecessarily extending the duration of the meeting.

Communication features such as instant messaging or chat functionality also help enable real-time communication among meeting participants. The ability to resolve a question or clarification quickly without having to interrupt the flow of the meeting can go a long way to accomplishing more during a meeting.

Many board software solutions also integrate with participants’ calendars. This allows for easy meeting scheduling and automatic reminders, reducing scheduling conflicts and improving meeting attendance. For virtual meetings, participants can join with one click directly from Aprio—whether you use Zoom, Teams, GoToMeeting or another video conferencing tool.

Benefit #4: Optimize Decision-Making

Board governance software can also include collaboration, communication and decision-making features to facilitate informative discussions and decisions among the leadership team or the board.

Credit unions use board management software to make faster and more strategic decisions. With secure document sharing, annotations, online voting and electronic signatures, the software helps improve ongoing communication between board members and executives, as well as exchange ideas, ask questions, and provide input during the decision-making process.

Benefit #5: Simplify Reporting

Board governance management software can help credit unions streamline their reporting efforts. For example, the software automatically tracks and documents the decisions made by leadership and the board by maintaining an audit trail of decision-making processes, including discussions, voting outcomes and action items assigned.

Aprio provides an automated audit trail of key compliance actions and dates to make regulatory reporting easy. Get access to several standard reports to track board activity including attendance, login behavior, groups and audit reporting.

Manage Your Board Governance Risk

Top board management features for credit unions include:

- online voting and electronic signatures to streamline approval processes and decisions;

- standard reports including an automated audit trail to simplify reporting and compliance;

- a task manager to keep executives and the board organized and accountable by tracking and assigning action items to individuals or groups;

- customized surveys and assessments to gather valuable feedback from executives and board members including board or CEO evaluations;

- an easy-to-use agenda builder to streamline the creation of meeting agendas, and assign time limits and presenters to keep meetings on track; and

- advanced layers of security including granular user permissions to allow or prohibit specific users from accessing or downloading documents.

Dee Sicklesteel is director of sales at CUES Supplier member Aprio, Vancouver, British Columbia.

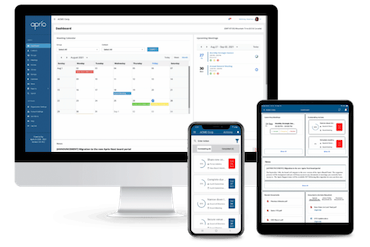

See Aprio’s Board Management Software In Action

Whether you’re considering adopting a board portal for credit unions for the first time, or looking to match a switch, assess the fit with Aprio.

We’d love to learn more about your credit union and how we can help support your governance goals.