5 minutes

Peer-to-peer (P2P) payments first emerged in the late 1990s as people and businesses searched for faster, more convenient alternatives to checks and cash. Early digital platforms made it possible to send and receive funds online, setting new standards for speed and ease in money movement.

Smartphone adoption in the 2010s accelerated this transformation. Mobile-first P2P apps brought simple, real-time transfers to the mainstream—whether splitting bills, paying rent, or sending money to friends. A 2025 Chase survey revealed that 67% of consumers reported using P2P payments, up from just 40% in 2020. Globally, P2P also dominates mobile-first payments—55% of consumers used mobile devices for P2P by the end of 2024.

With so many third-party apps competing for attention, financial institutions now have a prime opportunity: bring these transactions back into their own digital banking environments, where they can directly strengthen customer relationships.

Why Credit Unions Should Pay Attention

Consumers overwhelmingly prefer using their bank or credit union’s app for P2P. A recent survey found that 71% of consumers expect banks to offer integrated P2P, with 78% rating trust in bank-integrated P2P apps higher than standalone platforms.

Yet despite this preference, many institutions still route these payments through third-party providers—a gap waiting to be filled. Every transaction that occurs outside your digital channels is a missed login, a lost touchpoint, and reduced visibility into your customers' financial behavior.

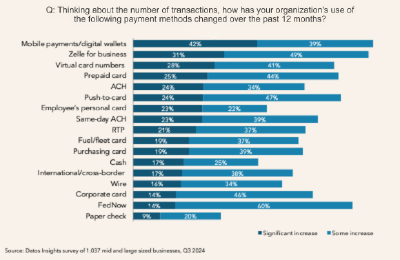

Small businesses are accelerating the use of P2P as well. P2P has expanded beyond personal transfers into use cases like commerce, payroll, and cash flow management—further emphasizing its strategic importance for FI apps. Zelle®, a prominent P2P solution, is emerging as one of the fastest-growing digital payment methods for businesses, second only to mobile wallets. Datos Insights’ Q3 2024 survey shows that while the total number of businesses adopting Zelle® has grown modestly, the volume of Zelle® transactions is accelerating sharply—with 31% of organizations reporting significant increases and another 49% noting some increase. This shows that Zelle® is moving beyond occasional use into a mainstream rail for business payments. With meaningful traction among banks and businesses, it’s a critical channel for driving engagement and keeping transaction volume within the financial institution ecosystem.

The Engagement Opportunity with Embedded P2P

Offering P2P directly within your digital banking app allows institutions to:

- Boost digital engagement: Frequent P2P use drives more logins, with one-third of consumers logging in weekly or more. This engagement builds “stickiness.” Each time a member logs in to send money to a friend or pay a small business, they’re reminded of the value your institution provides. It’s a daily or weekly reinforcement of relevance.

- Build trust: Members and customers trust banks and credit unions over fintech apps for handling payments, especially older generations. Embedding P2P allows you to combine that trust advantage with robust, institution-level fraud monitoring. This reduces concerns around phishing, account takeovers, or synthetic identity fraud.

- Unlock cross-sell opportunities: Logins don’t just drive engagement; they expand your ability to cross-sell. When members regularly use your app for P2P, you can showcase adjacent products—credit cards, loans, savings offers—within the same digital session. This is especially powerful for credit unions, where members value tailored solutions. Every P2P transaction is a chance to highlight relevant products that align with life events, from financing a new car to building emergency savings.

- Retain funds in-house: When transactions route through third-party apps, funds often leave your ecosystem. That not only reduces deposits but also limits your visibility into member activity. Embedded P2P keeps balances on your books, protects your role as the primary financial relationship, and ensures that valuable data on transaction behavior is available for analytics and personalization.

Future-Proofing with P2P

The outlook for P2P is strong. According to Allied Market Research, the market size—i.e., provider revenues from P2P solutions—was $2.9 billion in 2024 and is projected to reach $14.5 billion by 2034, a 17.3% compound annual growth rate from 2025–2034. This forecast speaks to sustained demand for institution-backed P2P, not just rising transaction volume.

For credit unions, that growth trajectory means P2P should be treated as a strategic capability, not a bolt-on. Embedding P2P in your digital banking stack today positions you to capture member activity as usage expands, while giving you a path to add adjacent rails (the RTP® network, the FedNow® Service, ACH, wires), small-business and disbursement use cases without re-architecting later.

What to do next:

- Prioritize a core-independent integration so P2P can scale alongside other rails.

- Centralize fraud, compliance, and reporting to manage growth efficiently.

- Use P2P engagement signals (frequency, counterparties, amounts) to personalize offers and deepen relationships.

P2P is no longer just convenient—it’s central to member engagement. By embedding P2P within your own apps, financial institutions can deepen relationships, capture more logins, and reaffirm their position as the trusted hub for money movement.

Alacriti’s centralized payment platform, Orbipay Payments Hub, provides innovation opportunities and the ability to make smart routing decisions at the financial institution to meet their individual needs. Financial institutions can take full ownership of their payments and control their evolution with TCH’s RTP® network, the FedNow® Service, Zelle®, Fedwire, ACH, and Visa Direct, all on one cloud-based platform. To speak with an Alacriti payments expert, please contact us at (908) 791-2916 or info@alacriti.com. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.