3 minutes

Brother and Sister teach young members to save.

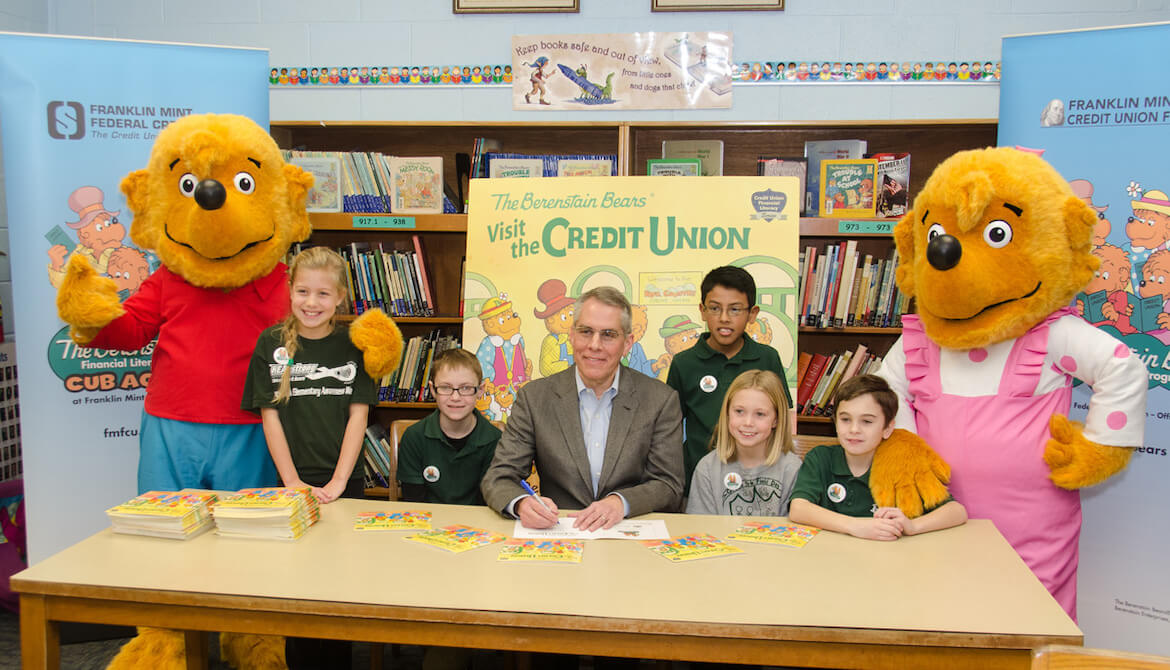

Popular storybook siblings have become ambassadors to encourage children to learn and practice key money management concepts—save, share, spend, earn—through the Berenstain Bears Financial Literacy Program offered exclusively to credit unions by the Credit Union Network for Financial Literacy.

Two picture books from the Credit Union Financial Literacy Series featuring the Berenstain Bear characters accompany elementary-level lesson plans and other educational and marketing materials, including the framework for a children’s savings account that has helped Franklin Mint Federal Credit Union, which owns the CUNFL credit union service organization, and other participating credit unions enroll entire families as members, says CUES member Drew Stanley, SVP/chief strategy officer for the $1 billion Broomall, Penn., credit union serving 84,000 members.

Since Franklin Mint FCU doubled the rate last summer on its Berenstain Bears Cub Account, a savings program available for children up to age 10, to 4 percent on the first $500, the average number of accounts opened monthly has increased from 60 to 100, and account balances average around $1,000, Stanley says. In almost 50 percent of the households where one or more children have a Cub Account, their parents have a checking account with the credit union, and 60 percent of those households have a loan. This program has helped keep the credit union’s average member age at 41 for more than five consecutive years, well below the national average.

Participating credit unions can purchase copies of the perennial favorite The Berenstain Bears’ Trouble with Money, adapted to be credit union-specific, and a new original book, The Berenstain Bears Visit the Credit Union, by Mike Berenstain, for distribution as part of a financial literacy program in local schools and community programs. The books can also be customized with the sponsoring credit union’s name and logo.

“We make this program as turnkey as possible, with recommendations on how to merge the education components and marketing,” says CUNFL account executive Lorraine Ranalli. “It includes guidelines for the Cub Accounts. The credit unions set the terms, but the program provides the branding.”

Before O Bee Credit Union, Tumwater, Wash. ($237 million, 25,000 members), signed on with CUNFL in October 2015, it had tried financial literacy events at local schools and libraries featuring its mascot bee character, “but it just never took off,” says CEO James Collins, a CUES member. “The Berenstain Bears offer instant recognition.”

O Bee CU has purchased Sister and Brother Bear costumes, typically donned by local high school drama students who read the books to children at school and library events scheduled weekly. Children get a take-home box with a Berenstain Bears book, pencils, erasers, stickers and information about the credit union’s Cub Accounts. The number of youth accounts at O Bee CU has increased from an average 14.9 per month before introducing the program to 42.7.

When they open an account or make a deposit, children through age 12 get a certificate for free ice cream at a local restaurant. “Kids love to run the coin machines in our branches, bring their deposit slips up to the teller, and get their ice cream coupon,” Collins says.

Participating credit unions are supporting financial literacy in their communities while simultaneously enhancing their brand image and member enrollment, says Rick Durante, VP/education with Franklin Mint FCU and national director of CUNFL.

“This is such an iconic brand, instantly recognizable to teachers, parents and children, that it lends extra credence and trust to a credit union’s commitment to financial education,” Durante notes.

Karen Bankston is a long-time contributor to Credit Union Management and writes about credit unions, membership growth, marketing, operations and technology. She is the proprietor of Precision Prose, Eugene, Ore.