2 minutes

This may be a great opportunity to restructure or tilt your balance sheet based on your interest rate risk profile.

This was originally published on c. myers’ blog and is reprinted with permission.

As the New Year gets underway, management teams and CFOs have already started thinking through the various x-factors that could impact earnings in 2019. At the top of the list for many decision-makers is a flat yield curve.

The potential of a flat Treasury yield curve has been looming for quite some time. In February 2018, one of our blog posts addressed how credit unions were finding opportunities in a narrowing yield curve. Since then, short-term rates have continued to increase, while long-term rates have decreased, resulting in a nearly flat Treasury yield curve.

While a flat Treasury yield curve can put pressure on earnings, credit unions are still proactively searching for opportunities within this rate environment. In particular, some institutions are viewing a flat yield curve as a great opportunity to restructure or tilt the balance sheet based on their interest rate risk profile. Below are a few examples.

Consider a credit union that feels it is positioned well for the current and down rate environments but is concerned about its risk if the rate environment were to increase materially. The credit union focuses on the investment portfolio in which it could reinvest excess liquidity into longer-term agencies, as it has done for years, or keep the funds in overnights to offset the risk of rates rising.

Years ago, the credit union would have been giving up a lot of earnings by not reaching out on the yield curve. The yield curve and rate environment reflect a different picture today.

Assuming the credit union is comfortable with the risk/return trade-off should rates head back down, current rates provide a unique opportunity to shift the balance sheet, lowering risk in higher rate environments without giving up much in earnings today.

Credit unions are also closely evaluating their lending strategy in this unique yield curve. Similar to the investment example above, years ago some credit unions gave up a lot of revenue focusing only on auto loans, ignoring mortgages. However, this is a new rate environment and yield curve. Mortgage rates have decreased over the past few months and some credit unions are discovering their auto new volume yields are actually higher than mortgage yields. After incorporating credit risk, it could be a situation where the net yield (yield – credit risk) is roughly the same between the two products.

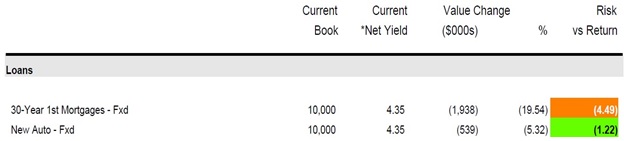

Given the +300-basis point value change and interest rate risk that often comes with mortgage loans, the table below helps show how autos can have a materially better risk versus return trade-off in today’s economic environment.

Regardless of the rate environment, decision-makers need to understand environments where they are positioned well and the potential weak spots. Opportunities can be found with a good understanding of the risk profile.

c. myers corporation has partnered with credit unions since 1991. The company’s philosophy is based on helping clients ask the right, and often tough, questions in order to create a solid foundation that links strategy and desired financial performance. c. myers has the experience of working with over 550 credit unions, including 50 percent of those over $1 billion in assets and about 25 percent over $100 million. They help credit unions think to differentiate and drive better decisions through real-time ALM decision information, CECL consulting, financial forecasting and consulting, liquidity services, strategic planning, strategic leadership development, process improvement and project management.