5 minutes

Gauges the board and management should watch.

Governing changes during crisis. Boards need to stay out of operational decision-making, yet they need to be aware of what is happening in the credit union. Awareness—even of bad news—is extremely important.

As the effects of COVID-19 ripple across the economy, the board and management need good, up-to-date information on key financial issues that may change rapidly. You don’t want any surprises during turmoil, such as what’s happening in the wake of the coronavirus. Surprises can destroy trust between the board and CEO.

A key to awareness is to develop and monitor systems of early indicators of financial changes taking place. In addition, with so much uncertainty, it is important for management to create a variety of projections based on different scenarios: best case, likely case and worst-case scenarios.

Manage the Balance Sheet: Capital and Deposits

A key to survival, now and always, is preserving capital (net worth). In recessions, the capital-to-assets ratio tends to drop rapidly. Why? Financial losses cause the dollar balance of capital to decline. But at the same time, growth in deposits can be a big contributor.

Members see credit unions as a safe haven for deposits during recession. Growing deposits causes assets to rise. If capital falls or stagnates and assets grow (caused by deposit growth), the capital-to-assets ratio will decline, sometimes precipitously. Managing your balance sheet by not attracting deposits you don’t need may be crucial. Making sure your deposit rates are set properly to attract only deposits you can benefit from will help you retain your financial soundness.

As a matter of fact, if you are starting with a low capital-to-assets ratio (say under 8.5%) and see it slipping dangerously, you may consider reducing your asset size by encouraging your members to deposit elsewhere. Such a decision isn’t made lightly, but if your capital situation is dire, it can be a way to remain financially sound. Several credit unions thriving today used this method to survive the Great Recession.

Loans are going to take a hit. This will reduce interest income and increase your provision for loan losses. An unhappy double whammy on profit. Using early indicators to identify weak loans, then preemptively reaching out to members, may keep more loans on the books. Delinquency and charge-off ratios don’t help. They are lagging indicators. I’m suggesting a series of reports that can give you early warning signals on weakening loans.

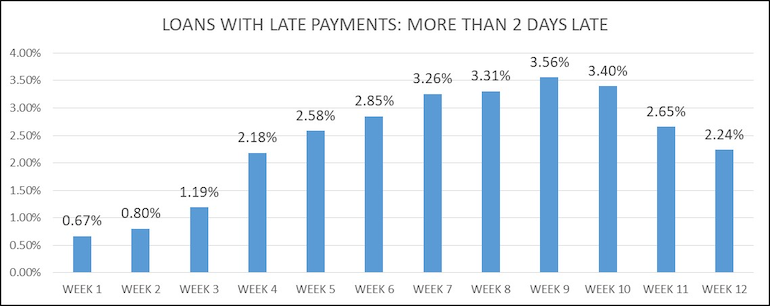

Percentage of Loans with Payments More than Two Days Late. Monitoring “late payments” by portfolio and by individual borrower is helpful. Some credit unions are tracking individual payment patterns to identify an aberration in a member’s payment pattern. If Mrs. Smith usually pays on the 25th and now her payment arrives on the 6th, she may be struggling.

Some credit unions can’t access that level of data. If you can’t, just begin flagging late payments. Either way, as soon as a member is late, reach out. For A and B paper, don’t wait 15 days to send a letter. Make a “soft call” at day 10 and say, “Mrs. Smith, we noted that your payment will soon be late. If you make your payment today, you can avoid the late fee. Could I transfer those funds for you?” This may result in a payment or in a dialogue that gives you more information about her financial position.

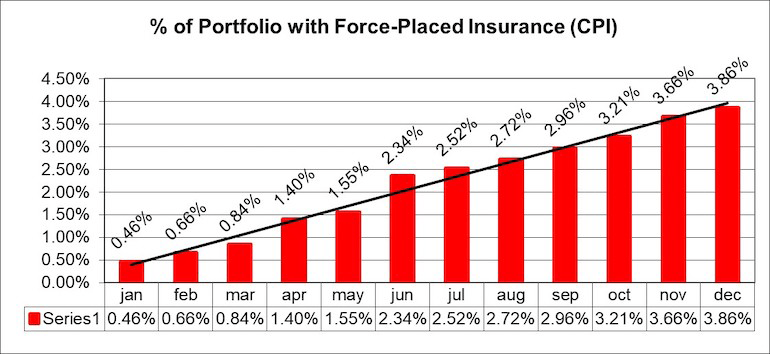

Percentage of Portfolio with Force-Placed Insurance. When financially stressed, members often pay loans but stop paying insurance. Contacting members immediately may help you save a loan or help a member. These reports can give the board and management a macro-picture of a portfolio. At the same time, at the member level, your staff can reach out.

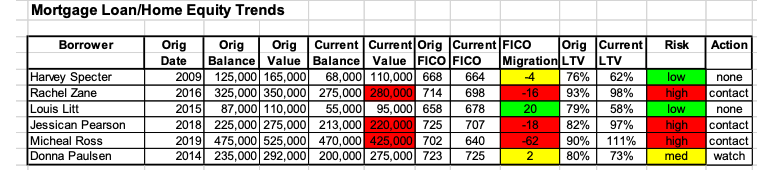

Reports of High-Importance Loans. High importance loans are large auto/consumer loans, mortgage loans, and commercial loans. We suggest triage using these reports to determine which loans and members are most important to contact right now. By monitoring and keeping up-to-date with the high importance loans, you will be more aware of your situation. By reaching out, you may be able to help your members and save their loans.

We suggest sharing these reports with the board on a bi-weekly basis. If you would like these report formats, please feel free to email me.

Allowance for Loan Losses. Your allowance for loan losses will likely increase dramatically and soon. The ALL calculation starts with historical loss ratios. Most credit unions look back 12 or 24 months for the historic loss ratio. Throw that out. Those ratios are suddenly irrelevant. It may be worthwhile to dust off the reports from 2009 to 2011 and use those ratios. The losses we are about to incur may be much more like what we experienced in the Great Recession.

Investments. Accounting principles require a decline in investment values to be booked to capital or to income in certain cases. Using mark-to-market accounting, a credit union must book market value declines for available for sale and trading securities. Be sure to monitor your investments’ values and appropriately record the changes occurring.

Setting up a new set of financial gauges can give you a window into the credit union’s key financial issues as this crisis progresses. Transparency and awareness are so important for the board and management team at this time. With this information available, you will be able to make better and faster decisions. This is not a time to panic, and there will even be opportunities in this chaotic period. But good data and information are key to keep your credit union from becoming another victim of COVID-19.

Tim Harrington is a CPA and CEO & Founder of TEAM Resources, a consulting firm helping credit unions thrive since 1996.

Apply It to Your Boardroom

1. How has your board changed its governance process during this pandemic crisis?

2. What are key ways your team is managing capital and deposits?

3. What financial gauges do you have in place at your credit union? Which ones are most useful?