10 minutes

Make your members the heroes of your credit union’s marketing and not the other way around.

For years, I’ve heard speakers at industry conferences tell credit union leaders that they have to “tell a better story.” I’d sit there thinking, “What does that even mean?”

I became really frustrated because even though I agreed with the recommendation, it felt toothless. There was no substance behind it, no practicality.

How do you tell a better story?

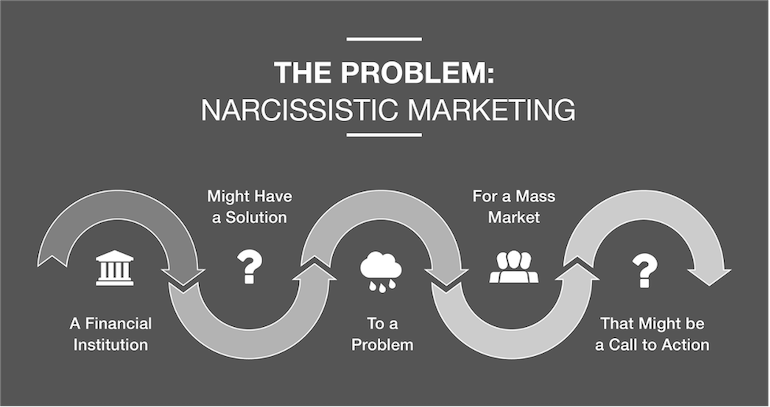

The Narcissistic Marketing Model

The heart of the matter is, from a marketing communication standpoint, financial brand stories have not changed over the years. For the majority of credit unions, the “story” can be distilled into three things:

- Promoting great rates

- Announcing amazing service

- Communicating commoditized laundry lists of look-alike product features

This is not only a bad story—it’s no story at all! It’s just a collection of facts. There’s more to financial brands than that, right? Of course there is. The problem is that when brands find their stories and begin to articulate them, they cast themselves as the hero.

This is what I call the narcissistic marketing model. Because they are the ones who solve the problem and save the day, financial brands are the heroes. Consumers don’t see it that way, though. In every story, there’s room for only one hero. And the hero isn’t the brand.

In the eyes of the consumer, they are the hero in this story.

Think back on your own life and the different stages or scenes within your own story. We all walk around believing we’re the hero in the narratives we tell ourselves, which is fair—we are the heroes of our own story.

People aren’t looking for a hero to come save them, and this is especially true when it comes to financial services. They’re looking for something greater, something deeper: they’re looking for a helpful guide that allows them to be the hero of their own story.

It’s time to step outside of yourself and let go of your ego.

We can learn so much, and ultimately transform our marketing and sales communication strategies, by looking back over thousands of years of literary history, all the way to the earliest recorded narratives.

Why is it so important to understand these narrative structures?

When it comes down to it, humans respond to stories, not just intellectually but also emotionally. Stories have bonded us together as human beings through the course of our existence as a species. Stories are key to our survival.

The best stories worth telling and remembering have a point of conflict, and these are the perfect moments to try to get someone to focus in. It’s during these points of conflict that our brains produce cortisol, increasing focus. Conflict captures attention.

On the flip side of cortisol is oxytocin, the “feel-good chemical” that promotes connection and empathy. This chemical is released in our brains when we see people’s faces and their emotional reactions within a story. This is even more true when we see faces of people who look like us. This is why telling a story visually, through images and video, can create such a powerful empathetic connection through emotional experiences.

Finally, we know there is a secret power that can be unlocked within a story’s happy ending. Because happy endings to a story trigger the limbic system to release dopamine, which in turn helps us feel more hopeful and optimistic.

Become the Helpful Guide

If we take Joseph Campbell’s hero’s journey framework and distill it into a more simplistic structure through the lens of financial brand marketing and sales strategies, we see the following key thematic elements:

- A hero has a problem

- Who meets a helpful and empathetic guide

- Who offers the hero a plan that provides clarity and builds their courage

- Which leads the hero to commit to take action with confidence

- Which ultimately results in the hero’s success

Without Obi-Wan, there’s no Luke and no Star Wars.

Without Mr. Miyagi, there’s no Daniel-san and no Karate Kid.

Without Gandalf, there’s no Frodo and no The Lord of the Rings.

Without the guide, there can be no hero, and without the hero, there can be no story.

The guide’s primary role in any story is to empathetically connect with, empower and elevate the hero on their journey. Your financial brand can no longer position itself as the hero within its marketing and sales communication. You must commit to position your financial brand as the helpful and empathetic guide, elevating the consumer to success as the hero.

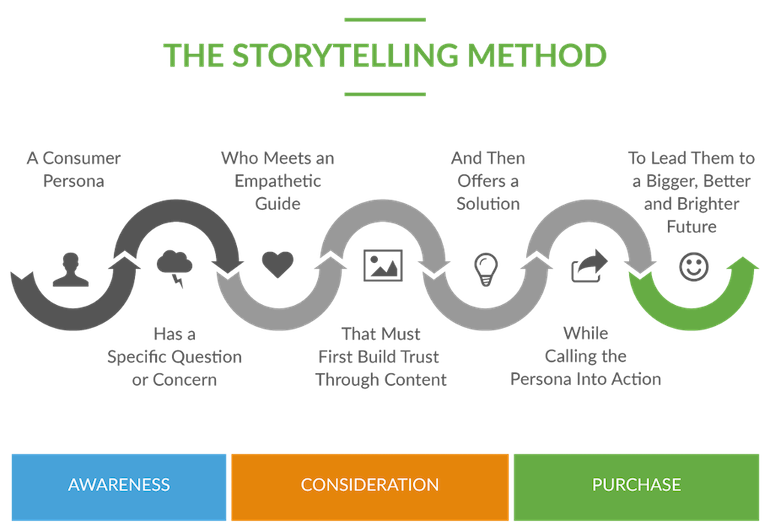

The 7-Step StorySelling Method

How do you escape the narcissistic marketing and sales communication that centers your financial brand as the hero? How do you begin to tell stories and position your financial brand as the helpful guide? More importantly, how do you tell stories that sell? Because let’s be honest, from a leadership perspective, what good are the stories we tell if the stories don’t generate leads for loans and deposits?

Human beings connect with stories about people like them. We quickly relate to average-Joe consumers who, with the help of an empathetic guide, get beyond their financial stress and realize their bigger, better, brighter future.

Your financial brand can confidently and consistently tell stories that sell by following the seven simple steps of the following StorySelling Method.

#1: Create a Consumer Persona (the Hero)

Human beings connect with stories about people like them. So the hero of your story should be a consumer persona: a semi-fictional representation of your ideal account holder, based on market research and real-world data.

When you use a consumer persona, the ideal consumers you hope to reach with the story will be more likely to emotionally connect with the hero. That emotional connection will be easier to achieve if you tell the story visually, through images and video. When we see people’s faces and their expressions—especially if they look like us—our brains release oxytocin, the “feel-good chemical” that promotes connection and empathy.

Pro tip: Focus is your friend here. If you try to be all things to all people, you will end up being nothing to no one.

#2: The Hero Has a Specific Question or Concern

This is where you lean into the consumer persona’s pain as you establish conflict other people will be able to connect with. For example, what’s keeping people up at night? How are they feeling about money?

You want to stir up negative emotion here—but only just a bit—because conflict causes the brain to release cortisol, increasing focus. Conflict captures consumers’ attention as they realize they, too, need a cure to the pain they’ve now related to.

#3: The Hero Meets an Empathetic Guide

Enter: your financial brand as an empathetic guide.

This is where many financial brands go wrong. They are stuck in the old narcissistic marketing model, where the story is all about them: their “great rates,” “amazing service,” and commoditized laundry list of look-alike product features.

This is why the empathetic portion is so important, because empathy is the antithesis of narcissism. Instead of focusing on the products or services you offer, focus on what the consumer persona—the hero of the story—needs.

To present yourself as an empathetic guide, communicate your financial brand’s purpose. People don’t buy what you do or how you do it; those are easily commoditized. People buy why you do it.

#4: The Guide First Must Build Trust through Content

Just like Luke didn’t trust Obi-Wan—a weird, old hermit living alone in the desert of Tatooine—at first in Star Wars, why should a consumer trust you pushing your commoditized products on them?

Trust must be built over time and is founded on two things: communication (what you say) and action (what you do). The best way to build trust digitally is through the production and promotion of content that helps first and sells second. Financial services are often inherently complex, so consumers are desperate for content that helps to simplify and guide their decisions.

#5: The Guide Then Offers a Solution

Once, and only once, you’ve established enough trust with a consumer through the content you produce and promote—content that, again, helps first and sells second—can you finally offer them a solution.

The solution is a prescription to cure the consumer persona’s problems and pain. Just as consumers are desperate for content that simplifies the complexity of financial services, they’re also desperate for simple, clear solutions. When they see a solution offered to the consumer persona, they will feel hopeful that there is a solution for them too.

#6: The Guide Calls the Hero to Action

The consumer will only take action once they have built up enough courage to commit to move forward with confidence. A call to action (CTA) can be the catalyst.

The CTAs in your story will differ based on the medium in which you are telling your story. Take your website, for example. To keep things simple, there are three types of website CTAs that build up consumer courage over time at every stage of their buying journey.

Clarity CTAs provide insight, guidance, and help early and often in the beginning stage of a consumer’s buying journey where they are first becoming aware of your financial brand (e.g., “Download the home-buying guidebook”).

Transitional CTAs are ideal for when a consumer is considering buying your product or service but needs to first talk to someone before they have enough courage and confidence to commit and click “apply” (e.g., “Request a call back to talk to someone”).

Direct CTAs are only offered at the very end of the consumer buying journey, once they’ve compared all their options and built up enough courage and confidence to commit to move forward and apply with your financial brand (e.g., “Apply for your loan in less than five minutes”).

#7: The Guide Leads the Hero to a Brighter Future

It is here the hero has finally broken free from their past and has arrived at their new state of being. These happy endings cause the brain to release dopamine, which makes us feel more hopeful and optimistic. When consumers see the hero achieve a bigger, better, and brighter future, it gives them hope that they can have a similar future, with your help.

To highlight these happy endings, consider the power of testimonials communicated via videos and podcasts, or even ratings and reviews embedded on the product pages of your website.

At the end of the day, all people truly want are two things: help and hope. And hope must often come before help, especially when a consumer is looking for someone they can trust to guide them beyond their questions and concerns.

Tell an Even Better Story to Maximize Digital Growth

For a story to sell, it doesn’t need to be flashy or elaborate. It just needs to tap into your consumers’ real problems and show them how you can guide them to a solution.

Real people, real problems, real solutions.

Consumers don’t want to hear about how great you are. They want to hear how you are going to make their lives better.

So it’s time to step outside of yourself and let go of your ego. You’re not the hero. Embrace your role as the helpful, empathetic guide, providing the tools needed for the true hero—the consumer—to succeed.

That’s how you tell an even better story to generate 10X more loans and deposits.

James Robert Lay is one of the world’s leading digital marketing authors, speakers, and advisors for financial brands. As a digital anthropologist based in Houston, Texas, James Robert is the author of the bestselling book, Banking on Digital Growth. He is also the founder and CEO of the Digital Growth Institute where he has guided more than 520 financial brands on a mission to simplify digital marketing and sales strategies that empower banks and credit unions to generate 10X more loans and deposits.