11 minutes

Understanding women’s financial lives is the first step to ensuring equal pay.

Growing up, my mother told me that I could be anything I wanted to be. The world was my oyster—there were just a few things I needed to do to start down and stay on a successful life path. I needed to work hard, get an education, pay myself first and never spend more than I made. Her advice was the same for both my brother and me. She was giving us what she thought were the foundations for a healthy financial life. What my mom didn’t tell me—and what most people don’t talk about—is that there are some fundamental differences between the financial lives of women and men.

As we prepare to mark Equal Pay Day in the U.S. (March 15 this year), which symbolizes how far into the year a woman must work in addition to her earnings from last year to have earned what a man had earned the previous year, it’s important to recognize the pay gap is just one aspect of how women’s financial lives are different. Understanding these differences will help us be mindful in our approach to gender parity and ultimately will help all of us live healthier financial lives.

A Financial Lifetime of Gaps

As we’ll see below, women face a lifetime of gaps that add up over time, putting them at greater financial risk.

Pay Gap

Most people have heard that women earn less than men. In 2021, the Payscale Gender Pay Gap Report found that the median salary difference for all men and women in the U.S., the uncontrolled gap, was $0.18. That is, women earned $0.82 for every $1.00 their male counterparts earned. When we look at equal pay for equal work, the controlled gap, comparing the median salary for men and women with the same job and qualifications, women earn $0.98 to men’s $1.00.

Well, OK, that’s pretty good news, right? It’s only a difference of $0.02 when we compare equal work for equal pay. Perhaps there is some room for optimism, as the gap has been lessening. In 2015, the uncontrolled gap was $0.24, where women earned $0.76 on the dollar compared to men, and the controlled gap was $0.97 for every dollar. However, there are two very important and impactful reasons the gap negatively affects women’s financial lives: First, equal work and having the same qualifications is still not equal when it comes to pay. And second, there are far fewer women who make it into the control gap comparison group throughout their career; if they do, it takes them significantly longer to get there.

Opportunity & Advancement Gaps

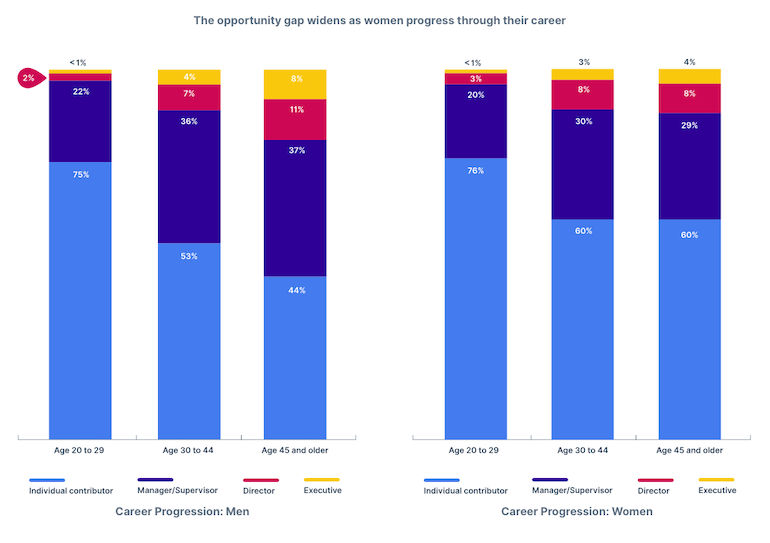

At the start of our careers, the playing field is relatively level. In 2021, the PayScale Report found that 76% of women and 75% of men ages 20 to 29 were in roles where they contributed individually. However, as women progress in their careers, they climb the ladder at significantly slower rates, and it would appear that their ladders are not as tall as men’s. At ages 30 to 44, only 30% of women had become managers or supervisors compared to 36% of men. By age 45 and older, 19% of men compared to 12% of women were in director or executive roles. Speaking to the height of the ladder, only 7% of women make it into an executive role at any given time during their career compared to 12% of men.

The pay gap widens when examining those at the top. For female executives, the uncontrolled pay gap is $0.70 on the dollar to what men make, and in the controlled gap, that number is $0.94 to the men’s dollar. (Remember, the controlled gap is the same job, same qualifications group.) The difference in pay in the uncontrolled group is likely because female executives tend to be in areas that pay less, such as HR and marketing rather than finance, IT and CEO roles. Another painful truth about this pay disparity is that advanced degrees don’t necessarily help women decrease the pay gap, either. MBAs have the highest uncontrolled pay gap of those with advanced degrees—women earn $0.76 on the dollar to their male counterparts.

Lifetime Earning Gap

Less pay plus less opportunity to advance into positions that pay more plus less pay for those who make it to advanced positions is a formula for a lifetime of diminished earnings.

According to the Pay Scale Report, the cumulative effect for the uncontrolled gap group ($0.82 to $1.00 in 2021) is that women over the span of a 40-year career—with the gap staying constant and assuming a 3% cost of living increase annually—will earn $3,830,000. For the controlled gap group, when women’s job characteristics are similar to men’s ($0.98 on the $1.00 in 2021), lifetime earnings increase to $4,600,000. Using this same calculation, the lifetime earnings for all men totals $4,680,000. That’s $850,000 less earnings in a lifetime for women in the uncontrolled gap group and $80,000 less for the controlled gap group. That might not seem significant when looking at the controlled gap group exclusively, but it’s still $80,000 less that women could have been saving and investing throughout a lifetime.

Retirement and Wealth Gap

When we get to the retirement aspect of women’s financial lives, the pay gap has turned into a significant wealth gap. According to the American Association of University Women, the average woman has $0.32 in wealth for every dollar of the average man, and that number is pennies on the dollar for women of color. Bank of America’s 2019 Workplace Benefits Report found that men have a median retirement savings balance of $100,000, whereas women have a median balance of just $30,000. Because women make less over their lifetime, their Social Security benefits are also smaller.

The diminished lifetime earnings and accumulation of wealth is even more troublesome to women’s financial health, because women tend to live longer than men—by five years according to the Center for Diseases Control. Worse yet, the older women get, the larger the life expectancy gap. For a couple that collectively reaches 64, two-thirds of women will outlive their male partners by 12 years.

Mind the Gap as an Individual & Organization

All of this information regarding the lifetime of financial gaps for women can be not only depressing, but overwhelming. What can we possibly do to lessen the cumulative gap and improve the financial lives of women? Perhaps the first order of business is to be mindful of it. The goal should be enlightenment and recognition, keeping the gap top of mind so that when we approach decisions, we think about the impact we can have on bettering the financial lives of women. To be impactful, this mindfulness needs to be undertaken individually and within our organizations.

Individually

Women tend to be the caregivers in their relationships and their families. The National Women’s Law Center finds that of the one in five Americans who are currently providing care to others, 58% of them are women. Oftentimes, all that caregiving means that women don’t care for themselves. This is especially true when it comes to their financial lives. Women need to follow my mom’s advice and not only pay themselves first, but put themselves first when it comes to their finances. A good starting place is for women to evaluate their risk tolerance—and perhaps even try to increase it, as women are notoriously risk-averse—then set goals and be diligent about assessing progress.

Women, after all, have the power of time. Finally, that longer life expectancy may actually pay off financially! Years ago, I had a financial planner ask me about my long-term goals, and I said I just need to be able to take care of Old Me. Care for Old Me is my number one financial goal and has been for years, as I recognize that prioritizing that now is not just giving myself care as I age, but my family as well. Women, pay yourselves first and do it consistently from the start of your financial life. Harness the power of compounding.

Another way that we can mind the gap is to check on the financial health of the women around us. Think about it as adopting a “we for she” mentality, which will make all of us allies to help women put themselves first. Ask the women around us how they are doing toward setting and achieving their financial goals. Bring it to the forefront and normalize the conversations about finances, as women are inclined to shy away from talking about their financial lives. A Merrill Lynch study found that 61% of women said they would rather discuss the details of their own death than money. Make talking about finances and goals a topic of conversation for everyone throughout their lifetime.

My parents did this for me early in my career. When I got my first job that had benefits, my parents had only one question for me about my new position: Did my employer offer a match to their 401(k)? They made sure that I understood why I needed to contribute the match amount at the very minimum. Honestly, at the time, meeting the match felt like losing so much money from my paycheck. If they hadn’t asked the question and brought it to the forefront, I likely wouldn’t have done it. I can think of several examples of questions and conversations with not only my parents but friends and colleagues throughout my financial life that have proved to be invaluable. Let’s check in with those we care about and start having candid conversations about money. Caring is sharing, especially when it comes to financial health.

Organizationally

Minding the gap as an organization is not only about conceptualizing how to help women put themselves and their financial lives first, but also by looking at our culture and practices to make sure we are constructing and protecting an environment that will allow women to advance. Despite a shift in social norms and perceptions regarding working women of childbearing age, bias still persists in the form of the motherhood penalty. A study commissioned by Bright Horizons and published in 2019 found that 41% of employed Americans perceive working moms to be less devoted to their work, and a third judged them for needing a more flexible schedule. We can combat this in our organizations by scrutinizing our recruiting and career pathing practices, asking what obstacles are in place or what perceptions of employees exist regarding how to advance. Review why women are moving forward at your credit union, and if they aren’t, ask what you need to change to remove obstacles to advancement.

Another aspect of minding the gap is to apply that “we for she” mindset in our organizations. Look at the skills and tools that all our employees need to advance, but focus on these two that women have struggled to gain access to historically: negotiation skills and mentorship. Both will not only advance individual employees, but will advance your organization as well. A good negotiator will not only apply that skill for themselves, but will do the same for your company when it comes to managing contracts and vendors. The same is true of mentorship. Ask how your organization can lift employees (and definitely our female leaders) up. Strong credit union leaders who help guide the next generation of leaders ultimately result in natural succession planning and greater bench strength for our organizations.

Key Takeaways

Women experience a financial lifetime of gaps. Understanding the cumulative effect of the pay, opportunity and advancement, earnings and wealth gaps is the first step to taking a mindful approach to strengthening women’s financial lives. Working together both personally and professionally, we can begin to impact meaningful change. As mindful allies in bettering financial lives, our goal for the near future should be to build a world where the gap is closed and Equal Pay Day is a thing of the past.

Bryn C. Conway, MBA, CUDE, principal of BC Consulting LLC, is a long-time member of the credit union community and helps credit unions define their brands, develop their experiences and grow market share.

Discuss the Pay Gap at CUES RealTalk!

Join us for this quarterly discussion and you will hear from a panel of accomplished female leaders, experts, and professionals in a candid discussion about the challenges women face in the workplace their male counterparts do not.