12 minutes

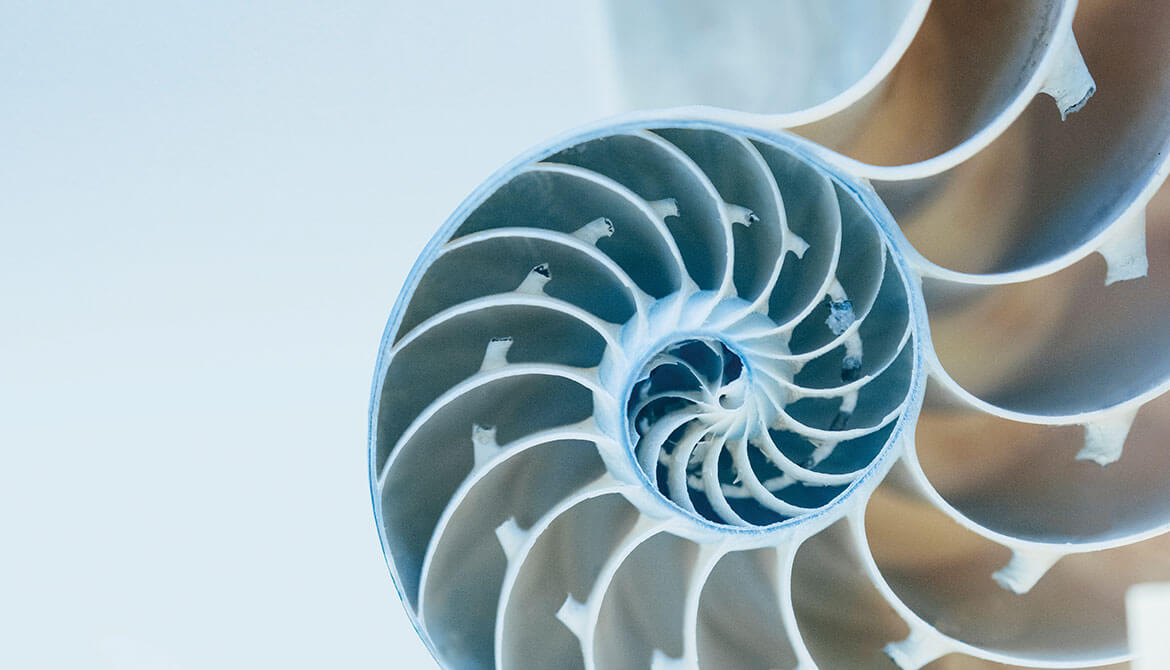

Like a nautilus, Hudson Valley Credit Union’s board evolves beautifully into its next stage of governance.

The nautilus is a shelled sea creature known for renewing itself in a most beautiful fashion. It builds a new chamber inside the cover of its shell, moves out of the compartment in which it has been living, and seals off the old. As it progresses over time, the nautilus creates an amazing spiral shell with many sections.

In an ideal world, credit union boards would renew themselves as the nautilus does—building on the old to create a new, more expansive governance space.

But how many credit unions engage in conversations about building the next era of board governance? In the 2020 State of Credit Union Governance, we reported that almost 25% of all board members have held their positions for at least 20 years. That’s okay to some extent because historical continuity is good. Institutional knowledge and accrued wisdom are important to tackling today’s complexities.

On the other hand, we’ve seen directors who perpetuated a negative culture for decades and boards where members were battling serious age-related health issues. We’ve also seen boards struggle under the weight of training too many newcomers, people with insufficient experience joining the boards of $2 billion credit unions, and recent additions who didn’t understand the difference between governing and managing.

How do credit union boards transition to their next stage more like the nautilus—gracefully striking a balance between historical continuity and the next right steps for the board and the organization overall?

When leaders at $6.5 billion Hudson Valley Credit Union (hvcu.org), Poughkeepsie, New York, decided it was time to take a fresh, top-to-bottom look at the board’s nominations process, we were privileged to accompany them and provide our professional guidance along the way. We are grateful to them for letting us tell you their elegant and effective story of board renewal.

“As our credit union continued to grow to over $6 billion, we knew we needed to transform our governance,” says Board Chair Nancy Kappler-Foster, a CUES member. “Through our work with Quantum Governance and Dolus Advisors on increasing the effectiveness of our policies and practices—and in particular the constructive partnership between the board and the CEO—we understood the next step was to focus on the ideal board and supervisory committee of the future and then build a state-of-the-art nominations process to achieve that.”

Getting Started

Led by Kappler-Foster, the board began by chartering a new governance and nominations committee, integrating the original nominations committee as a subcommittee within a broader governance committee charter; redefining the roles and responsibilities for board members; and reevaluating its board-level committee structure overall. Next, the board examined its entire nominations process from recruiting to onboarding.

We facilitated workshops with the board, management and supervisory committee that enabled Hudson Valley CU’s volunteers and management team members to commit to a new process that:

- Developed an overall vision for the nominations process, attending to group dynamics, tone and culture, trust, psychological safety and, of course, good governance.

- Leveraged decision science, combining business tactics, technology and behavioral sciences through a collaborative approach to help leaders make optimal, data-driven decisions.

- Surveyed the decision landscape, identifying and evaluating the credit union’s needs and ultimate goals at the board and supervisory committee levels and forecasting the probable consequences of its decisions.

- Challenged everyone involved to overcome their biases and blind spots, subordinating their own personal interests to the credit union’s best interests.

- Valued character in the boardroom as highly as key performance indicators, identifying not only hard skills and expertise but also character traits and attributes to drive the identification and prioritization of candidates.

Identifying Needed Skills and Attributes

We helped Hudson Valley CU’s leaders clarify the skills and attributes they sought in new board and supervisory committee members. Like many CUs, Hudson Valley CU’s leaders hadn’t revisited their wish list in ages. (See Hudson Valley Credit Union's Call for Board Candidates Refresh for the CU’s “before” and “after” calls for candidates.)

We looked to data to guide the way toward a new standard. The 2020 State of Credit Union Governance report found significant differences between what credit unions sought in their candidates and the skills and attributes they actually valued in the boardroom.

And Hudson Valley CU was no different. When we surveyed the CU’s board, supervisory committee members and management, we found they had been prioritizing skills in financial literacy, professional services and operations. However, the perceived value of those skills in the boardroom was significantly lower than for human skills like being able to focus on the future, do critical thinking and be independent-minded. We recommended that the CU prioritize (in both its recruitment and nominations processes) what its leaders value most in the boardroom. In actuality, the shift was likely long overdue, as it is for most credit unions.

Following an analysis of their survey data and focused work with both the volunteer and management leadership, Hudson Valley CU developed a new call for candidates that delineated specific skills, attributes and character traits that matched the credit union’s changing governance needs, culture and core values—in alignment with what board members actually value in the boardroom. (See sidebar, “Hudson Valley CU’s Call for Candidates Refresh.”)

“I was so gratified to see the change in focus from fiduciary- to strategic-related skills for our new board members,” says President/CEO Mary Madden, CCE, a CUES member who has announced her retirement effective Jan. 2, 2023. “As we look to the future and the $10 billion threshold (by 2027), the management team will be looking to our board to ask the hard questions that need to be asked from a strategic point of view, while we’re overseeing the day-to-day operations. Certainly, board members need to continue to be responsive to their fiduciary duties, but strategically, there are a lot of critical, strategic decisions in front of us.”

The Candidate Process

Historically, Hudson Valley CU used traditional routes for board recruitment—issuing the call for candidates on its website and in member statements and posting it in its branches. The CU’s nominations subcommittee leveraged AVP/PR and Corporate Communications Lisa Morris to help get the word out in new ways. Morris placed ads on LinkedIn, sent word out to the area’s largest chambers of commerce, and conducted outreach through other specialty membership organizations and associations in the CU’s region. For the first time, board members took a more active role in recruiting.

All told, Hudson Valley CU received 18 applications for three open seats for its board last year. In the end, new board members came from board and volunteer referrals and Morris’ outreach to the Professionals of Color Network Hudson Valley. Morris believes casting the net wide was a value-add.

“Any additional outreach we do as a credit union—whether it’s marketing for a new product or issuing the call for candidates to and through a new association—means we’re reaching potential new members,” she says.

A CEO once told Quantum Governance that his board was so concerned that he would “stack the deck” in his favor, he wasn’t even allowed to know how many applications his credit union received in response to the call for candidates. We took the opposite tack, recommending that Hudson Valley CU include Madden in the entire process. As a result, she participated as an ex-officio, non-voting member of the nominations subcommittee, lending her decades of expertise in interviewing, evaluating and vetting high-level professional candidates.

“At first, we were all a bit skeptical about including Mary in the process,” said Julie Majak, the current chair of Hudson Valley CU’s nominations subcommittee. “But having her participate was an important, positive change. After we reminded ourselves that she had a voice—not a vote—we all quickly moved on to benefit greatly from our CEO’s expertise and insights. Her participation is now a given moving forward.”

We also recommended the nominations subcommittee add a peer evaluation for any incumbent candidates, as well as psychometric testing in the form of the EverthingDISC Workplace Profile and expand interviews from 20 minutes to an hour. We also helped the committee develop strategic interview question sets to be used for all candidates to test the issues most important to the credit union.

Importantly, the nominations subcommittee approached each interview with a new, elevated perspective of what was required and a clear understanding of what the board was looking for in new volunteers.

We recommended Hudson Valley CU use a five-point scale for evaluating candidates based on the outcome of the assessment. Future board members should be: skilled enough to be board chair (even though it might never be right for them to be chair, see January '22 Good Governance article); critical and strategic thinkers; independent-minded; consensus-builders; and of unimpeachable integrity. We also suggested the nominations subcommittee prioritize diverse candidates and individuals with previous board experience and expertise in the financial realm.

The nominations subcommittee selected five of the 18 candidates to interview, ultimately nominating three candidates who were later elected to the board. The subcommittee also launched an associate board member program. (At cues.org/boardpolicies, see package 1). This enabled bringing in a strong fourth candidate as an associate director, creating the opportunity to increase the candidate’s general knowledge of CU governance over time, while benefitting immediately from the candidate’s attributes and expertise.

The Onboarding Process

Not content with improving only the nominations process, Hudson Valley CU’s leadership also focused on enhancing its onboarding program for new volunteers. A small task force comprising both board and staff was created and led by an expert in training from the CU’s HR department. The task force expanded the CU’s original, skeletal onboarding process into a robust program that includes a 15-plus hour, four-session orientation curriculum with homework assignments and between-session learning. The program also includes a variety of training modalities and sources, including online modules from CUES; in-person presentations from staff and board members; and written materials.

Beyond the orientation curriculum, Hudson Valley CU has committed to at least a 12-month onboarding process that includes regular check-ins by the board chair, committee assignments and access to the CEO, and management representatives who can provide tools, answer questions and serve as subject matter experts to help new directors understand the nuances of the CU industry, the CU’s budget, executive compensation and the economy, plus learn how their strategic decisions apply to and impact operations and results. Hudson Valley CU eventually aims to have all its volunteers and supervisory committee members participate in the onboarding process.

The Human Dimensions of the Process

We would be remiss if we didn’t address the challenges that such a significant amount of change raised. Implementing this multi-phase process was a massive undertaking for Hudson Valley CU’s board, supervisory committee and nominations subcommittee, and it represented a gap-leaping progression in the leaders’ ability to meet members’ needs. (For more, read, “Key Outcomes and Lessons Learned From a Board Renewal Effort”.)

Successful organizational change involves more than good processes and procedures. People are the pivotal element, and enabling them to integrate new ways of thinking about and doing things is often the most challenging task.

The starting point for change is recognizing that it’s needed. Implicitly, there must have been reasons, acknowledged or not, why any action hadn’t come sooner.

The reasons change is hard and the right ways to contend with oppositional forces are unique to each situation. Still, Hudson Valley CU’s journey was not uncommon. Its particulars aside, we hope—as does the CU’s leadership—their story will be helpful for others contemplating similar enhancements.

Board composition did shift over time at Hudson Valley CU, so a stagnated boardroom cohort was not the main board renewal problem the credit union faced. Rather, the board had not empowered the previous nominations subcommittee to function as a strategically important committee—recruiting the best candidates, helping to refresh the strategic makeup of the board and revitalizing its vision. While today the nominations committee is viewed by the board as one of its most consequential committees, it had been for years reduced to a group of people who executed the simple task of managing the logistics of the nominations process, with little to no strategic input or impact to the overall makeup of the board.

Another consequence of that legacy was a contingent that strongly believed that maintaining the status quo was in the CU’s best interest. In their view, the introduction of innovative tools and processes to enhance Hudson Valley CU’s culture and governance posed a threat to the long-held assumption that the nominations process needed to be completely independent from the board and even management. Although the board had signed off on the innovations, some members of the nominations subcommittee concluded that the changes would be detrimental.

“Some members of the committee were uncomfortable with the amount of dramatic change the consultants were looking to implement so quickly,” says CUES member Misty Decker, chair of the governance and nominations committee.

In such a situation, building trust and giving the naturally conservative individuals the courage to try are what’s needed more than anything else. The antidote to resistance and anxiety-driven risk aversion is assurance, not force.

Our approach was to mobilize a small group of institutional leaders—the board chair, the CEO, and the governance and nominations committee chair—to join us in a conversation with the nominations subcommittee members. We acknowledged that the proposed systemic changes were indeed a substantial and understandably frightening departure from the past. We heard their concerns, validating rather than dismissing their impassioned drive to guard normed cultural traditions, and we invited them to question and reconsider the benefits to change.

“We were ultimately successful,” Decker adds, “because we had established trust in Quantum Governance’s experience addressing board issues with other credit unions and in Dolus Advisors’ expertise in driving organizational culture change.”

Of course, the realities of dealing with stakeholder pushback are rarely straightforward. Navigating opposition can get hot and messy. Agreeing to disagree, building or re-establishing trust, and defining workable pathways to compromise can be arduous.

But there is no more important work.

And this work is and has been a powerful reminder that high-performing boards are a combination of capabilities and practices coupled with human dynamics and culture. Each of these areas entails differently defined tools and solutions to enhance or repair as well as to strengthen and elevate. They also require a healthy dose of humility to accept—and even celebrate—that the changes we embrace are actually only a work in progress. cues icon

Jennie Boden is president of consulting services at CUES strategic partner Quantum Governance. She has 30 years of experience in the national nonprofit sector and has served as chief staff officer for two nonprofits.

Alexander Stein, Ph.D., is founder of Dolus Advisors, a consultancy that helps leaders address psychologically complex organizational challenges.

The authors offer their gratitude to the board, CEO, supervisory committee, senior management, the nominations subcommittee, and the governance and nominations committee at Hudson Valley Credit Union for permitting us to publicly discuss this aspect of our work with them. Their willingness to share for the benefit of the CU community is a hallmark of their exceptional attitude toward governance excellence.