4 minutes

Cloud-based solutions allowed Trellance to focus on community rather than disaster recovery in the wake of the storm.

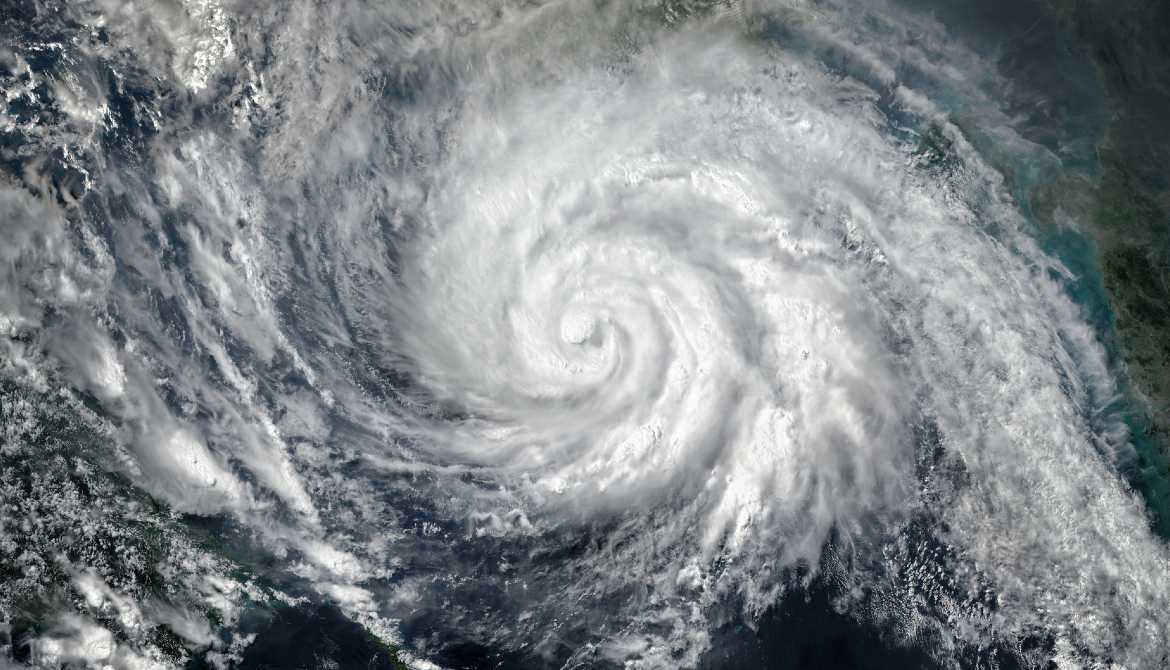

On Sept. 27, under mandatory evacuation orders due to the impending Hurricane Ian, Trellance shut down our Tampa offices and redeployed to safer locations. We were concerned for our employees, our physical offices and the Tampa community—but business concerns were noticeably absent. Despite how severe the storm could and would grow, we knew our data and technology were secure and business would carry on as usual.

How could we be so confident? The cloud-based solutions we so strongly encourage our credit union clients to adopt were very thing that made a potentially stressful situation practically a nonevent.

Most credit unions won’t be affected by hurricanes, but data security and business continuity threats are everywhere. Through that lens, here are four key lessons about cloud adoption that can be gleaned from the experience.

1. Without the cloud, reacting quickly is nearly impossible.

Hurricanes typically provide a fair amount of advance warning, but many threats do not.

When it came time to evacuate, it was largely a matter of relocating employees with laptops to safer locations where they could simply get back online and access all of our systems, files and information, which were synced and up-to-date in the cloud. This can be achieved in a matter of hours.

Had we been operating with on-premise data servers, we’d have been enacting a redundancy plan that involved “failing over” to another system, likely in a different state. This carries its own risks, and you have to do it not once, but twice, to bring the data back again later. It’s not a simple process. In most emergency scenarios, time is a rare luxury.

2. You can’t replicate what a cloud provider does.

Though your data and information are “in the cloud,” there is still physical infrastructure somewhere. The big cloud providers have built their data centers with incredible detail. They are in geographic locations that have considered potential threats, weather patterns and even tectonic plates, and they are often protected by physical berms. The buildings are tightly guarded with extraordinarily strict security policies. There are dozens of methods in place to keep the centers online and powered at all times, and redundancies are spread across regions, coasts and continents. If something were to take out an entire data center, it would have likely no effect on its users due to the inherent redundancies.

Your credit union is leveraging all of this—without the work!—when you move your data to the cloud.

3. A non-cloud backup plan is expensive and tedious.

If you’re not leveraging cloud providers built-in contingency mechanisms, you will need to have your own backup in place. That means creating and maintaining an entire additional set of data infrastructure that replicates your current system. You’ll bear the costs of building and maintaining a system that will be rarely, if ever, be used except for an annual test. You won’t just be on the hook for the technology costs but the additional expenses to keep it continually powered, appropriately cooled and in optimum working condition in case a failover is needed.

And to be honest, even if you spare no expense to keep your backup in good working order, relying on a failover to work perfectly can be quite scary. Most credit unions aren’t in the business of being technology experts, and the cost of the added time and stress alone—particularly during an emergency—is extraordinarily high.

4. In an emergency, cloud solutions allow you to keep your attention on others.

The core of the credit union mission is service to members and the community. During an emergency situation, members will need easy access to financial services, and remaining online becomes even more critical. If your systems aren’t hosted in the cloud, you may be offline for a period as you work to implement your backup plans, and that implementation will demand a lot of resources and attention from your technology team.

When your cloud provider is sharing the responsibility of keeping your data available and secure, this attention can be redirected elsewhere. In a situation where credit union employees need to work from another location, they can securely access files and information in the cloud from anywhere. Being in the cloud puts your credit union in a better position to keep your focus where it really matters—helping your members and neighbors in the community.

During the week-long evacuation period, Hurricane Ian could have completely destroyed our offices. Thankfully, it didn’t. Even then, it wouldn’t have destroyed our company—or even interrupted our services—thanks in large part to our use of the cloud. No matter where the risk comes from, we hope every credit union can experience that peace of mind.

Doug Vanderpool is chief technology officer at CUES Supplier member Trellance, Tampa, Florida. Learn more at www.trellance.com.