15 minutes

Employee resource groups offer a path for team members to embrace your credit union’s mission—and to grow personally and professionally.

Creating a corporate culture that mirrors your mission and values is crucial to credit unions—and indeed, any employer—today. Employee resource groups are emerging as pivotal platforms for fostering diversity, inclusivity and employee engagement. The Great Place to Work Institute describes ERGs as “voluntary, employee-led groups whose aim is to foster a diverse, inclusive workplace aligned with the organizations they serve.” When implemented strategically, they can become much more than that.

Consider these stats from ZipDo:

- 90% of Fortune 500 companies have an ERG.

- ERGs can result in a 39% increase in job satisfaction.

- There has been a 29% increase in employee engagement by ERGs over the past five years.

Below, four credit union leaders share their insights on ERGs and the niche they’ve found in their respective workplaces.

Sandia Laboratory Federal Credit Union: Launching the Women’s Initiative Network

BJ Jones, chief diversity and impact officer at $3.6 billion Sandia Laboratory Federal Credit Union, Albuquerque, New Mexico, has witnessed the evolution of ERGs at her organization. Notably, Jones’ own career trajectory at SLFCU has been central to the initiative, underscored by her commitment to nurturing a diverse culture and a human resources and organizational development background dedicated to fostering cultural diversity and excellence.

“Introducing ERGs was a strategic move to provide a platform for underrepresented groups—to amplify their voices and exchange ideas,” explains Jones. “These groups empower diverse identities across gender, race, sexual orientation, ability and more. The Women’s Initiative Network (known as WIN), our first ERG, specifically addresses the needs of female employees and their allies.”

Ensuring the ERG supports the needs of a credit union’s workforce is fundamental. “The Women’s Initiative Network, being our first ERG, was established to focus on SLFCU’s largest employee demographic—women,” says Jones. “It’s designed to foster dialogue and support professional and personal growth. The success of this group has also helped us prepare the foundation for future ERGs.”

A Structured Approach

Jones notes that each ERG must operate with a clear structure. Initial steps included defining guidelines, gauging staff interest, drafting a purpose statement and identifying executive champions. “Any potential group must align with SLFCU’s purpose and values and have clear roles and responsibilities,” adds Jones. “Upon approval, each ERG receives an annual budget and identifies relevant KPIs (key performance indicators) to measure impact.”

For example, Jones serves as the executive sponsor for WIN, while two vice presidents act as champions. “This structure ensures that the group remains employee-led, encouraging active participation and leadership from within the group,” she says. “Group activities include community engagement, career development and event planning.”

While being employee-driven, Jones notes that executive champions still play a crucial role in strategic alignment, advocacy, increasing participation and creating a supportive environment. They also help integrate ERG activities within the broader organizational culture.

For example:

- Strategic Alignment: The champions ensure alignment between the ERG and senior leadership, provide crucial business insights and advocate for the group.

- Increased Participation: Executives champion ERG efforts by attending events, promoting participation and communicating the value of these programs.

- Supportive Environment: Champions are allies in creating a psychologically safe workplace and investing in the professional development of ERG leaders.

Challenges and Achievements

Initially, Jones faced challenges in ensuring participation and buy-in across different levels of the organization. However, the CU’s structured approach and strategic selection of the credit union’s first ERG ensured a focused, impactful implementation.

She reiterates the importance of meeting your workforce’s unique needs while ensuring top-level support. “These groups support underserved employees and contribute significantly to organizational culture while fostering trust and engagement—creating a win-win solution for all.”

Ent Credit Union: Women Empowered

Under the leadership of CUES member Mollie Bell, chief development officer for $10 billion Ent Credit Union, Colorado Springs, ERGs characterize a dynamic, employee-focused corporate culture.

In the summer of 2020, Ent CU introduced its ERG program. One group, Women Empowered (known as WE), is designed to encourage and inspire women. Initiated by a passionate group of female leaders, WE was founded on the principles of “LIFTTed”—an acronym representing Leaders, Inclusive, Fulfilled, Trailblazing and Tenacious.

“WE has evolved from focusing primarily on advocacy to being a resource-rich, support-oriented group,” explains Bell. “It offers multiple opportunities for professional growth, ranging from book club discussions and workshops on effective communication to sharing inspiring stories about overcoming challenges and celebrating individual successes.”

Networking within the group has been another significant advantage, as have impactful mentorships. According to Bell, these naturally formed mentorships among members have offered members of WE specific insights and coaching. “This guidance has facilitated career progression and fostered lasting friendships,” she adds. The group has also participated in “numerous fun activities, like curating playlists of female-empowering music, supporting female-owned businesses, and participating in events and conferences.”

Today, each ERG at Ent CU must undergo an application process requiring a governing charter and board. “The purpose and activities of each group must align with our commitment to a culture of belonging and diversity,” says Bell. “The focus should include advocacy, professional development, community outreach and belonging, while management plays a supportive role, providing sponsorship and funding.”

Defining Success

Measurable results have been vital in understanding success, with Ent CU using tools like the Gallup Q12 and the Culture of Inclusion Assessment to gauge the effectiveness of the overarching ERG strategy. Key findings since implementing its first ERG include:

- Higher Gallup engagement scores among ERG members.

- Ent CU’s overall Gallup Q12 engagement scores in 2022 and 2023 were 4.32 and 4.33, respectively. Currently, the credit union is in the 95th percentile of engagement for organizations this size.

- In 2022, for survey participants who are members of an ERG, the engagement rate was 4.37. In 2023, ERG members’ engagement was 4.39.

- Greater positive feedback on the culture of belonging and thriving.

- In 2023, the credit union began to measure belonging and thriving—two different but related measures—through its annual employee engagement surveys. The thrive index measures employees’ current and future resiliency, and belonging is measured by asking whether employees can show up as themselves.

- Both indicators in 2023 were more substantial for those Ent CU team members who participated in ERGs. Given that this was a baseline survey, the credit union will monitor it again during 2024.

- Strategic improvements in employee engagement and resource allocation.

- Bell reiterates an ERG’s role in fostering professional growth. “We’ve seen enhanced employee engagement and discovered new ways to offer additional developmental opportunities. In 2024, we plan to further support these initiatives by introducing stipends for ERG board officers while continuing to provide an annual budget for group activities.”

Each ERG is allocated a $5,000 budget, which covers a variety of needs, such as engaging speakers, contributing to community nonprofits with aligned missions, purchasing co-branded merchandise (featuring both the Ent and ERG logos) and covering other event-related costs such as food. The stipends for board officers are intended as gifts of appreciation for their efforts in steering and amplifying the impact of their respective ERGs.

Challenges and Evolution

Like any new undertaking, launching the ERG program at Ent CU hasn’t been without obstacles. “For example, adapting our goals to include ‘belonging’ and ‘thriving’ indices required a nuanced understanding of employee needs,” Bell explains. “We considered the importance of mental and emotional wellness overall for team members—how they feel both at work and in their personal lives. A better understanding of these factors has allowed us to allocate resources in ways that, hopefully, impact lives in a much bigger way.”

Bell also maintains that ERGs must strike a balance between employee-led governance and executive support. “Our goal as executives is to support team members without being heavy-handed or controlling, allowing team members to take on new accountabilities and collaborate to create spaces that feel safe and foster a sense of belonging,” she adds.

Looking to the future, Bell sees an ongoing presence for ERGs in her credit union, emphasizing the importance of belonging as a cultural strategy. “Our approach to ERGs is a testament to the power of employee-led initiatives while fostering an inclusive, thriving workplace,” she concludes. “We’ve created a winning formula by empowering employees, respecting their diversity and aligning these groups with organizational goals.”

Kinecta Credit Union: Introducing the Kinecta 99s

In an era where workplace diversity and inclusivity are pivotal for organizational success, $6.8 billion Kinecta Credit Union, Manhattan Beach, California, sets the standard with its women-focused ERG, the Kinecta 99s. Consider these insights from CUES member Kim Graham, SVP/chief people officer at Kinecta, as she outlines the initiative’s inception, structure, impact and evolution.

Structure and Operation

The Kinecta 99s group was established in 2018, deriving its name from Kinecta CU’s rich history with Hughes Aircraft: The 99s, the ERG’s namesake, is an international organization of female pilots founded by 99 women in 1929. (Amelia Earhart was the first president.) Graham notes that the ERG emerged from a grassroots employee initiative by a few women who felt a need for a collaborative networking platform for women within the credit union.

“They started meeting to discuss creating a supportive environment, and the 99s were born,” Graham says. “The group became an official ERG several years later when Kinecta launched a company-wide effort to form other ERGs to support the different needs of employees.”

Today, the group is dedicated to empowering women through various means and is open to anyone from Kinecta CU. Priorities include facilitating networking, providing development support and fostering leadership advancement.

Specific Goals:

- Providing a safe, supportive space for discussion on women-centric issues. Issues include work-life balance and women in leadership.

- Advocating for well-being in family, health and workplace. Ideas have centered on work-life balance, healthy living and creating a supportive environment at work.

- Offering resources and opportunities towards greater equity. These include sharing relevant webinars and books (through the Kinecta 99s book group) and lunch-and-learn sessions featuring such topics as breast cancer awareness.

Graham notes that promoting women’s advancement in leadership through informal mentoring and sponsorship has been central to success. “All ERGs are employee-driven; when employees show an interest, they must collaborate with the human resources department to find an executive sponsor, which is essential for guidance and support,” she adds. “Each ERG has a leader and co-leader, ensuring structured governance.”

Executive buy-in has also been pivotal to the success of the group. “We recognized a need within our organization for employees to discuss issues affecting women,” says Graham. “We wanted to ensure we offered a safe and inclusive space for open, supportive and honest conversations.”

When forming the Kinecta 99s, the founding members had many objectives, with these top priorities:

- Executive Buy-In: Securing top management support, which is crucial for sustainability;

- Employee Interest: Utilizing surveys or focus groups to help gauge the need for such groups;

- Charter Development: Outlining clear goals and objectives;

- Leadership and Executive Sponsors: Assigning executive sponsors and leadership roles;

- Budget: Ensuring adequate funding for ERG activities; and

- Events and Promotion: Organizing meetings and activities that foster engagement and growth.

Success and Evolution

Since its inception, the Kinecta 99s group has made significant strides, with its influence extending beyond individual growth to contribute to a more inclusive and diverse organizational culture. Recent initiatives include:

- Hosting webinars and events focusing on women’s issues, like breast cancer understanding and International Women’s Day celebrations.

- Offering an informal women’s mentorship program and establishing family-friendly workplace initiatives, such as designating parking spots for mothers-to-be and families.

- Contributing to members’ professional development, evidenced by members’ participation in Kinecta’s leadership programs.

- Partnering with other ERGs to deliver programming that impacts a diverse range of ERG initiatives.

While the core goals of the Kinecta 99s have remained consistent, the group continually looks for new ways to get the message out to the organization and focuses “on creating more opportunities for women within the credit union sector,” notes Graham. “We’ve seen great success, marked by participation in events, noted advancement of women in the workplace and the feedback received about the impact the support group has had on individuals.”

UW Credit Union: The Women’s Initiative Network

At $5 billion UW Credit Union, Madison, Wisconsin, the implementation of ERGs underscores a deep-seated commitment to cultivating a workplace that values diversity and collaboration. Victoria Boucher, community engagement strategist at UWCU, highlights these groups’ profound influence in reshaping the employee experience and enriching the organizational culture.

The Genesis of WIN

Established in 2018, UWCU’s Women’s Initiative Network—or WIN—was born from a shared vision to promote women’s growth, connection and community participation. Boucher has observed that WIN not only furthers the cause of women within the credit union but also dovetails perfectly with UWCU's comprehensive diversity, equity and inclusion objectives.

“The group operates with two co-leads, supported by various committee leads and members,” she says. “We offer additional support, bolstered by DEI staff, who offer liaison oversight, resources, coaching and an executive sponsor. Today, nearly 40% of UWCU employees are part of an ERG, with WIN being the largest, boasting over 100 members.”

The success of WIN is reflected in its programming that facilitates connections virtually and in person across various branch and office locations. Programming has ranged from membership meetings and hosting internal speakers to Women’s History Month celebrations. UWCU’s ERGs, including WIN, also support such local nonprofits as Operation Fresh Start, Extended Hands Food Pantry and many more, through paid volunteer time-off benefits, supply drives and community events.

Impact and Achievements

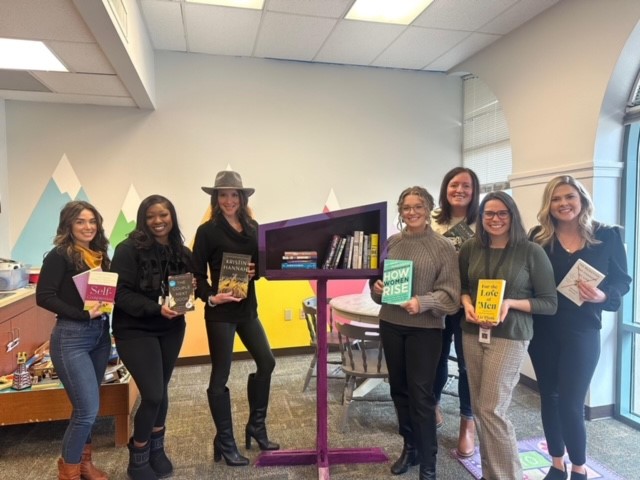

Initially focused on increasing the representation of women in leadership, WIN’s objectives have expanded to encompass broader employee growth and connection. This includes offering book clubs, professional headshots, financial wellness training, mentoring circles and initiatives that foster career advancement and employee engagement.

Since the formation of ERGs at UWCU, the organization has seen tremendous growth and change, even as the pandemic prompted unique organizational challenges. Recent progress has included the following:

- Expanding parental and caregiver leave policies, enhancing the engagement and retention of women in the workforce.

- Maintaining workplace collaboration while shifting to a hybrid work model.

- Increasing representation of women in leadership, with women now comprising 47% of the senior management team, a notable increase since WIN’s formation.

“This progress is felt regularly in the WIN Teams channel (an internal communications network), where members can champion one another’s success and career progression,” Boucher says. “Regular recognition and celebration highlight the powerful connections ERGs have built at UWCU.”

The Need for ERGs

Boucher believes that ERGs like WIN demonstrate their importance in meeting the needs of employees and enhancing workplace culture at UWCU. For credit unions looking to establish a program, she recommends:

- Assessing employee interests alongside business needs. Define what success looks like, as well as shared objectives and expectations.

- Setting ERG leaders up for success and ensuring there is organizational capacity to provide necessary resources, including training and coaching.

- Prioritizing opportunities for senior and executive leaders to engage with ERGs. Valuable insights for both groups can emerge from shared events and relationship-building efforts.

The Women’s Initiative Network at UWCU is a testament to the transformative power of ERGs in promoting a more inclusive, supportive workplace. Through WIN, the credit union has enhanced its employees’ professional and personal lives and set a benchmark for other credit unions to follow in their journey toward creating a more diverse and equitable workplace.

A Blueprint for ERG Success

Under the direction of BJ Jones, chief diversity and impact officer, $3.6 billion Sandia Laboratory Federal Credit Union, Albuquerque, New Mexico, has established a clear and structured approach for employees interested in forming new employee resource groups.

Jones shares these ten steps to follow when forming an ERG at her credit union:

- Initial Development:

- Read and Understand: Employees interested in forming an ERG must begin by familiarizing themselves with the credit union’s ERG guidelines.

- Gauge Interest: At least 10 employees must express interest in forming the group.

- Draft Purpose Statement: The group must prepare a purpose statement that reflects its objectives.

- DEI Consultation: Group leaders need to discuss the proposal with the chief diversity and impact officer and identify potential executive champion(s).

- Naming the Group:

- The group’s name is decided by its members, subject to approval by the executive champion(s).

- Guidelines and Charter:

- ERGs are grassroots groups representing various demographics linked by common interests. They are formally established upon the approval of a group charter.

- The charter should align the group with SLFCU’s purpose, values and strategy.

- Roles and Responsibilities:

- Members are expected to actively participate in creating a purpose statement; practice empathy; serve as champions for diversity, equity and inclusion; and submit annual reports detailing progress and future plans.

- SLFCU Alignment:

- Each ERG must have one or two executive champions from the VP level. These champions are crucial in integrating the ERG’s activities with the broader organizational culture.

- Objectives:

- ERGs aim to support diversity, equity and inclusion, share knowledge, work as an employee support system, assist in recruitment and retention efforts, and bring new ideas to the leadership team.

- Budget:

- ERGs receive an annual budget of $7,500 (pro-rated for partial years) for professional development, program activities and networking.

- Key Performance Indicators:

- ERGs must select relevant KPIs to measure impact, including employee engagement, development and retention metrics.

- Membership:

- While open to all employees, participation should be coordinated with the employee’s job responsibilities and supported by their immediate leader.

- Meetings & Activities:

- ERGs are expected to meet quarterly and commit additional time for various activities. These meetings and activities encompass a range of events, from professional development to community engagement.

The structure and guidelines provided by SLFCU for forming and operating ERGs underscore the organization’s commitment to diversity, equity and inclusion. By establishing a straightforward process, roles, and expectations, SLFCU facilitates forming these groups and ensures their alignment with the organization’s broader strategic goals. This approach can be a model for other credit unions looking to implement effective and impactful ERGs. cues icon

Owner of Fab Prose & Professional Writing, Stephanie Schwenn Sebring assists credit unions, industry suppliers and any company wanting great content and a clear brand voice. Follow her on Twitter/X @fabprose.