6 minutes

Explore AI-human interaction concepts for your next strategic planning session

In many organizations, discussions about artificial intelligence (AI) and its impact on business occur daily. Articles, news stories, podcasts, speeches, and webcasts discuss AI as a profound transformation that will supplement and augment human capabilities and shift the nature of our work. AI transformation, by its very definition, involves a fundamental shift in an organization's business model, culture, and operations. This level of transformation is drastically different from incremental and daily operational shifts familiar to and embodied in credit unions.

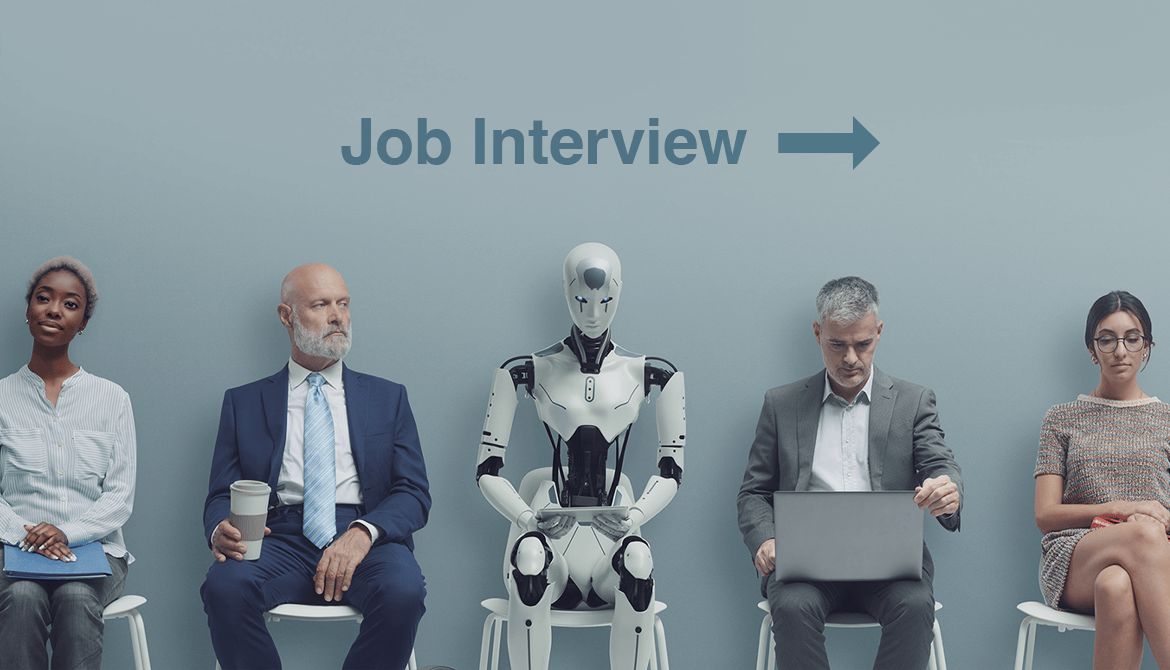

This article begins to explore AI-human interaction concepts for your next strategic planning session, evaluating your organization's future needs to ensure alignment with your strategic trajectory, and reassessing why your recruitment, retention, and professional development efforts must shift rapidly. These concepts are introductory and designed to stimulate mind-mapping for your upcoming strategic conversations, highlighting the magnitude of AI's transformation on organizations, which surpasses that of the Great Recession and Covid-19.

Amplify and Shift the Strategic Conversation

Every strategic planning session this fall should have a material conversation about strategically adopting AI and the pace and cadence of that adoption as integral to the business model. In the past, boards and teams have declared their position on adopting new ways of thinking about the future. Favorite sayings include: let’s grow yet not for the sake of growth, we won’t be on the bleeding edge (of innovation), we'll talk about a merger only if we're are dominant in the transaction, and the pace of change needs to be comfortable for all employees. Some declare their perspective on change from a mindset of entrenched complacency, reactiveness, enterprise-wide risks/rewards, or in the context of high-performance governance practices.

Questions such as these are used as filters to shut out, slow down, or invite needed change:

- Do we want to be on the bleeding edge, do we want to be fast followers, or do we need to keep doing what we're doing with our business practices?

- Will we be forced to accept generative AI as integral to our business model?

- Will we likely reduce total staff because of AI? If so, when? How many people will lose their jobs because of AI?

- If the organization were starting from scratch today without employees, products, services, and market opportunities, how would we embrace critical and strategic thinking, innovation, and AI?

Imagine what it would be like if questions that typically stem from three concerns were no longer an issue: genuine anxiety about employees, the cost of modifying technologies, and modern skillsets needed in roles of governance, leadership, and individual contributors.

Rich conversations and dialogue result in alignment on a shared future vision that maximizes the workforce and how we produce and deliver products and services.

Conversations from a future-focused mindset of boards and their CEOs assessing and moving strategically in adopting AI stimulate robust dialogue on the following:

- Customizing and personalizing intelligent information and marketing to identify what is important to each member.

- Optimizing delivery ecosystems to serve each member uniquely.

- Identifying new market opportunities to augment current member products and services.

- Assessing the significant investment needed in core technology upgrades to leverage generative AI.

- Assessing and enhancing risk management across the enterprise from an AI perspective.

- Redefining the employee value proposition by reimagining human-AI collaboration.

- Critically assessing the current leadership team to understand if we have the competency and desire to start the cultural shift towards data-driven decision-making.

- Understanding potential skills that will be in greater demand due to AI.

- Shifting our board of directors' expertise and business acumen to understand generative AI's strategic framework and impact.

- Preparing our workforce to be capable of focusing on higher value activities that require critical thinking, creativity, innovation, and emotional intelligence.

- Aligning leadership in vision, strategy, and execution of an AI-augmented workforce.

Strategic Action: Redefine the Workforce

Assume your organization is well aware of the need to invest in reskilling and upskilling its employee population to fill the emerging roles. Delaying strategic reskilling, upskilling, and defining new roles come with a high cost to remain relevant and competitive. Actively redefining your organizational structure, its systems, policies, and procedures, including workforce considerations, should all be on the table.

For example, the best practice recruitment strategies focus on attracting and retaining talent in an AI-driven world by redefining roles and developing a compelling employee value proposition. Revise your position descriptions to incorporate AI-related strategic and critical thinking to enhance generative AI capabilities. Update your interview techniques and train your interviewers in AI-relevant interviewing skills. Readily integrate AI dialogue in strategic conversations. Distinguish, at every governance and leadership level, the three categories of AI, as in these examples:

Point AI: Strategically decide the priority of points in the workflow that can be AI augmented. Here are examples.

- Fraud Detection and Anti-Money Laundering (AML): Fraud and AML analysts will shift their focus from manual data review to complex investigations, leveraging AI algorithms to analyze large volumes of data and identify indicative patterns of suspicious activity.

- Automated Member Service (Chatbots): Quicker response to member inquiries regarding basic inquiries and transactions, reducing the workload of the call center.

- Credit Decisioning: Streamline the credit decision-making process by analyzing a wider range of data points and providing insights into risk assessment, leading to more efficient and personalized member experiences.

Systems AI: Improve the risk management function with end-to-end compliance monitoring across federal and state regulations and policy guidelines.

- End-to-End Compliance Monitoring: Institute AI to monitor compliance risks across various regulations, automating the review of member complaints for fair lending or identifying compliance gaps within the first and second lines of defense. Move beyond standalone point solutions to a comprehensive compliance framework, increasing the focus on strategic risk management.

- Personalized Offers via Data Analytics: Institute a data analytics system orientation to analyze member data across different channels and evaluate potential preferred products and services. Marketing efforts are more integrated and less siloed on products and services.

Enterprise AI: Institute an enterprise-wide orientation to optimize and customize member delivery ecosystems in a digital-first experience for employees across the enterprise and members in our markets.

- Data-Driven, AI-Enabled Financial Institutions: Evolving beyond the point and system concepts, leverage AI to create highly personalized and intelligent information and marketing, optimize delivery ecosystems, and power a shift to digital-first experiences across the entire institution. This requires a significant investment in core technology upgrades and a cultural shift towards data-driven decision-making across the enterprise.

- Strategic Growth through AI-Powered Insights: Financial institutions can utilize AI to identify new market opportunities, optimize product offerings, and enhance risk management across all business lines, leading to increased growth opportunities. This extends beyond individual process improvements to fundamentally reshape strategic planning, which requires an enterprise-wide knowledge, experience, and commitment.

- Transforming the Employee Value Proposition: Develop compelling employee value propositions that cater to your digital-native employees, who are accustomed to and expect a digital-first environment. They would welcome AI-human integration, enabling them to focus on the more enjoyable and purpose-driven aspects of their work.

Opportunistic Times

Multiple opportunities for AI-human integration can lead to the credit union industry's sustainability and competitive positioning. CEOs are responsible for bringing to the forefront the strategic choice of AI integration as part of their long-term visioning conversation. Human resources and organizational development subject matter experts are accountable for reframing the foundation of recruiting and developing employees to keep pace with the required data analytics and critical thinking skills needed. Board members are responsible for assessing the board's readiness to engage in governance conversations from a leadership perspective.

It would be difficult and risky to sit on the sidelines and watch; instead, be engaged, learn, insert yourself into rigorous conversation, and make offers and requests to appropriately advance the concept of AI as fully integrated into the business of credit unions very shortly.

Deedee Myers, PhD, MSC, PCC, is CEO of DDJ Myers, an ALM First company out of Phoenix, AZ DDJ Myers, Ltd. is committed to supporting credit unions with exemplary products and services for board development and governance, strategic planning, executive search, executive compensation advice, and succession planning. The firm’s leadership coaches provide top tier executive and board coaching and facilitation of individual, organization and board assessments.