3 minutes

Lower-touch payments options are becoming increasingly popular. Here’s how you can stay ahead of the game and meet your members’ needs.

Sponsored by SWBC

There is no doubt that the coronavirus has disrupted nearly every aspect of our daily lives and ushered us into a “new normal” that is still rapidly evolving. As we adjust to our new reality, consumer behaviors and preferences are shifting. Ubiquitous anxiety over the spread of the virus has caused consumers to pay far more attention to their health and safety, including when it comes to making payments. We’re using food delivery services, curbside grocery pickup, and shopping more online to keep ourselves and others safe.

For credit unions, paying attention to evolving member preferences when it comes to payment options is now critically important. In this article, we’ll discuss trends in the market that point to more rapid adoption of contactless payment methods and give you some practical steps for how you can stay ahead of the game and meet your members’ needs.

Rapid Adoption of Contactless Payments

To make a contactless payment, you simply hold a credit or debit card up to a payment terminal and it automatically reads the card information. Before the coronavirus crisis, Americans had not fully bought in to using this technology, especially when compared to its wide-spread use in other countries. In 2019, Visa reported that only 0.18% of point-of-sale transactions were contactless.

“The coronavirus could be the tipping point for contactless in the United States. The question has always been ‘what will get consumers to change their payment behavior?’ Given coronavirus fears, I think we now have the answer.” – Demitry Estrin, CEO of The Futurist Group

In an age where consumers are eager to limit their contact with cashiers and frequently used surfaces, however, contactless payments are seeing a surge, and card issuers are keeping pace. According to Business Insider, “Most credit card issuers now offer contactless cards, including American Express, Chase, Citi and Wells Fargo. You can ask for a replacement card that's enabled for contactless payments if you have an older version.”

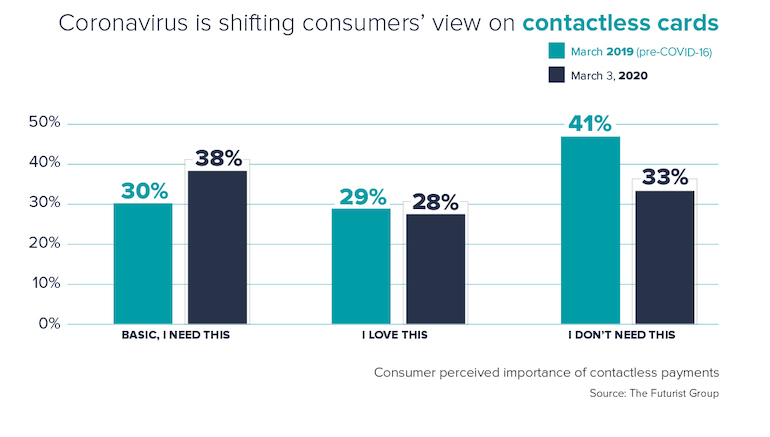

A study conducted by The Futurist Group in March illustrates the recent shift in consumer preferences toward contactless payments. According to the study, in the early weeks after the coronavirus was declared a global pandemic, 38% of consumers felt that they needed a contactless payment option as a basic feature of their card—an 8% increase from this time last year. Fewer consumers—41% in 2019, compared to 30% in 2020—now say that they don’t need a contactless payment option. It is highly likely that these percentage differences have increased in the past months as the pandemic has progressed.

Practical Next Steps for Credit Unions

As the country begins to reopen and we begin to navigate our new normal, communicating with your borrowers about what payment options you offer will be key. According to The Futurist Group, “In this moment in time, [financial institutions] must increase awareness of the contactless feature on their cards. Targeted marketing efforts must go beyond explaining the functionality and instead educate consumers about all benefits that contactless can offer. Responsible communication should prioritize those who are at the highest risk for infection.”

Now that consumers are expressing a preference for being able to tap their card for instant payment transactions and more companies are providing and accepting them, experts believe that the tipping point for contactless payments in America has arrived. For credit unions, this means that investing in the latest card-based technology to keep up with consumers’ expectations of fast, easy, and safe transactions is going to be paramount going forward.

As account VP for the financial institution group at CUES Supplier member SWBC, San Antonio, Texas, Brad Eral serves financial institutions throughout the Midwest with lending services, insurance and loss mitigation programs. Before joining SWBC, Brad worked in the software space helping retailers leverage technology to improve their customer experience. For a more in-depth analysis of consumer payment preferences, download SWBC’s free ebook, Equal & Opposite Reactions: Payments Preferences Across the Generational Divide.