3 minutes

These complex financial instruments are useful for executive retention and as corporate investments.

Sponsored by TriscendNP

Indexed universal life policies have multiple applications in credit unions and other businesses. These types of products are often used in key employee retention strategies and as corporate investment vehicles. While IUL sales growth has been rapid over the last decade, clients often misunderstand how the crediting mechanism on these policies works, and the economic factors that impact the product. Below, we describe how it operates, the potential benefits and important factors to consider when evaluating a purchase.

Understanding IUL Crediting

IUL insurance policies are permanent life insurance contracts with both cash value and death benefit components. IUL can be designed with the primary goal of efficient cash accumulation, provision of a death benefit or a blend of objectives. Several terms are used when describing IUL crediting, and knowing their meaning is essential to understanding how they work.

- Floor. The minimum rate the policy’s cash value will be credited.

- Cap. The maximum rate the policy’s cash value will be credited.

- Participation Rate. The percentage extent the policy is credited the index change (the difference between the ending index value and the beginning index value).

- Segment Term. The period over which the index change will be determined.

How Policy Crediting Works

IUL is unique in that crediting the policy’s cash value is based on a major stock market index change but subject to a minimum and maximum crediting rate. This floor and cap are referred to as a “collar.” The collar reduces crediting rate risk while providing the opportunity to generate attractive rates.

Index examples include:

- S&P 500

- The Nasdaq Composite

- Russell 2000

- Blended indices

Though policy values are credited based on index changes, cash values are not invested directly in the market. Index credits are applied to the policy’s cash value on its anniversary date. Policy crediting is most commonly based on the change in the index strategy for a year (segment term).

See the following example assuming an S&P 500 Index allocation with a segment term ending Sept. 17, 2020. For this example, the policy is assumed to have a floor of 0%, a cap of 10.50%, and a participation rate of 100%.

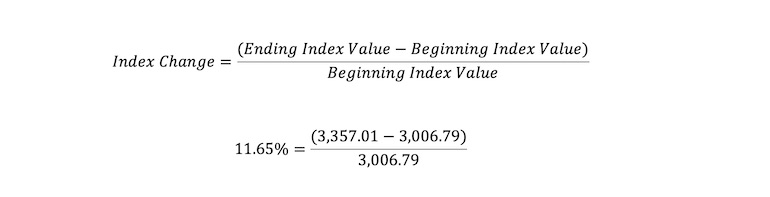

Step 1. Calculate the index change.

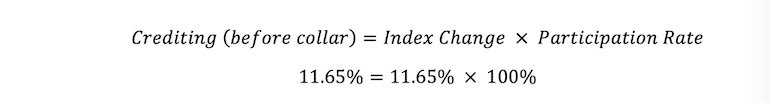

Step 2. Multiply the Step 1 result by the participation rate.

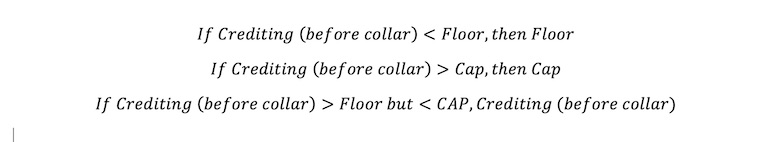

Step 3. Compare the result of Step 2 to the policy’s collar.

Are the Cap and Floor Rates Subject to Change?

A life insurance company can change the Cap or the participation rate, but the floor will not change. In our experience, the Cap changes based on economic conditions. However, once established, the cap and participation rate cannot be changed at the beginning of a segment term.

Favorable Features of IUL

- Higher return potential compared to whole life and fixed universal life insurance

- Death benefit protection

- Multiple index strategy options

- Elimination of negative crediting

IUL Pitfalls to Avoid

- While returns in IUL policies are favorable, we recommend stress testing illustration results with a lower crediting expectation

- Limited choices for cash value allocation

- Policies receive crediting once per year

IUL policies can be valuable personal or corporate assets. However, they are not always the right solution, and leadership should thoroughly review these products before making a decision. IUL policies are complex financial instruments, and credit unions should seek representation by expert advisers as part of the review process.

Zeinab Zangeneh serves in the role of benefit analyst and supports both the business development and client relations departments at TriscendNP, a CUES Supplier member based in Flower Mound, Texas. With primary responsibilities in design modeling and analysis of in-force supplemental executive retirement plans, Zangeneh assesses the suitability and stability of new and existing retirement benefit programs. She works in tandem with strategic partners on plan designs and presentations while also assisting in the development and management of departmental processes.