2 minutes

Six things to consider as you get ready to be part of the industry’s future.

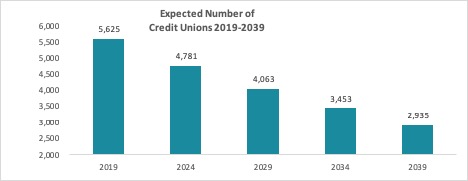

We’ve all seen the trend of credit unions ceasing to exist at the rate of about one every other business day. Using National Credit Union Administration data, in 2018, the number of credit unions declined by 175.

Interestingly, we continually hear boards and management teams focus on strategic targets and goals that seemingly ignore this reality—the typical thought being that “our” organization is different and will beat the odds. As such, it will end up being a survivor for the long term (assuming some magic wand is waved by the credit union growth fairy!)

Truth be told, credit unions haven’t had to focus on growth and posture (relative position with respect to the averages in the marketplace) within the market as a strategic imperative. You simply served your members (often from a limited company, industry or government/educational group) and they remained loyal to you for the duration. Fast forward to today, and credit unions have largely migrated to community-based charters, meaning you and every financial institution in the market (including other CUs) are fighting for relevance among the folks in the community you serve.

With this dynamic in place, credit unions have to be able to keep pace with tech innovation, security enhancements, and operational efficiency in addition to the long-term core values of outstanding service and competitive loan/deposit pricing. Against this backdrop, scale truly matters, hence the drive for credit unions to achieve scale in an aggressive manner.

With these pressures, as credit unions develop their strategic growth goals, what does the backdrop look like? At what rate do you need to grow to keep pace with the market? At what pace do you need to grow to gain posture within the marketplace? Finally, the hard question: At what point should the CEO, the board or the executive team decide that other strategic options are warranted (merger/assumption/closure)?

Projected Trends Using Average of 2017 and 2018 Attrition Rates From the National Credit Union Administration

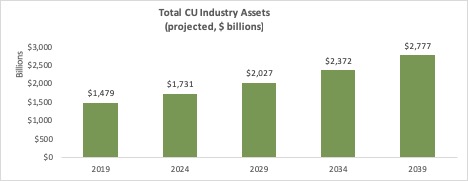

Aside from “Bank Transfer Day,” credit unions have maintained a relatively steady aggregate asset growth rate—largely derived from growth in the U.S. aggregate deposit base. Using this trend as a predictor, we can make an educated guess at the future level of assets in the credit union market in the following table.

CU System Asset Projection Using Historical 5-Year Trend

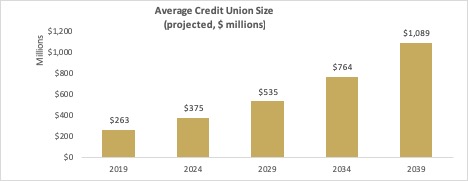

By looking at industry averages, growth rates and using past trends to model long-term assumptions, we can try to project what the “average-sized” credit union may look like in the future.

Of course, fewer credit unions and higher total assets in the system means the “average” credit union must reflect those changes as well. Again, using the projections above, we see the following trend in the “average” credit union over time:

Given this potential future state, what does your credit union need to consider?

- At least 7.4 percent annual asset growth to maintain your posture in the marketplace

- A business model and strategic objectives aligned with that reality

- Evaluation of leadership team to execute the strategy

- Alignment of internal goals and measures with this reality

- Squeezing every bit of effectiveness from your operating structure

- Keeping your key leaders to carry out your long-term plan

John Moreno is senior managing director of CUES Supplier member Meyer-Chatfield Group, Jenkintown, Pennsylvania.