4 minutes

Amidst concerns that the coronavirus can linger on surfaces including cash, electronic transactions grow.

Sponsored by SWBC

As health officials around the globe seek to contain the novel coronavirus that causes COVID-19, economies and citizens remain unsettled. In recent times in the United States, public events have been canceled, the government has discouraged gatherings of more than 10 people, and such businesses as bars and restaurants have been forced to close their doors.

In the face of this changing reality, consumer behavior is shifting. People are adopting strenuous social distancing measures in an attempt to limit the spread of the virus. This includes opting for food delivery services to avoid crowds at grocery stores, canceling non-essential travel plans, limiting interactions with cashiers, and minimizing contact with potentially contaminated surfaces.

Recent research suggests that coronavirus can live for three days on some hard surfaces, such as plastic and steel, and cash is a notorious hideout for germs and bacteria. A recent government study of banknotes collected in Ohio showed that 94% of them were infected with pathogens, including E. coli, Salmonella, and Staphylococcus aureus.

The federal government is taking measures to ensure that cash transactions aren’t fueling the spread of coronavirus. In the past several weeks, new precautionary measures were enacted that increase the minimum holding period from banknotes coming into the country from Asia and Europe from five to 10 days. Since February, Chinese officials have begun requiring state banks in Hubei province sanitize their bills with ultraviolet light and then store them for two weeks before releasing them to the public.

The World Health Organization recommends washing your hands or using hand sanitizer after handling cash or coins. All of this is fueling the rapid adoption of contactless payments methods in the U.S.

The Shift to Contactless Payments

Contactless payments are made by holding a debit or credit card near a payment terminal and, until recently, Americans had been hesitant to adopt this technology. According to Visa, as recently as the summer of 2019, contactless payments accounted for only 0.18% of payment transactions in the U.S., while outside of the U.S., 48% of in-person transactions are contactless.

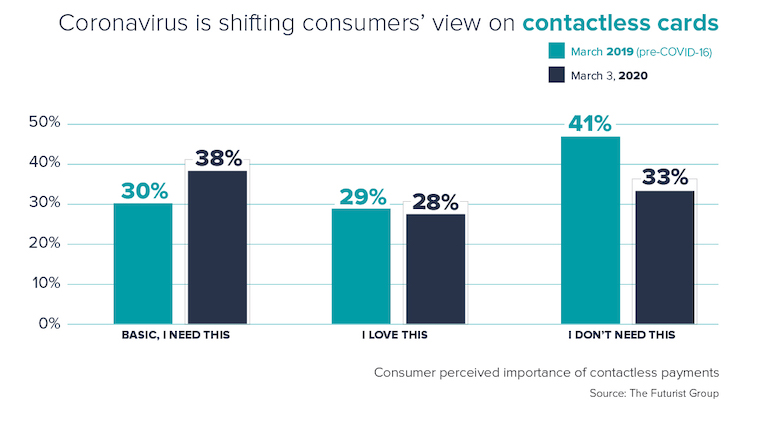

With the change in public perception precipitated by the coronavirus, however, this is starting to change. According to this article, The Futurist Group recently conducted a two-wave study of 3,187 U.S. consumers before and after the coronavirus began spreading. About 38% of consumers now see contactless as a basic need or feature of payments, up from 30% a year ago. The percentage of consumers saying they don’t need contactless payments has fallen from 41% in March 2019 to 33% in March 2020.

Experts believe contactless payments will be the wave of the future as more merchants begin to accept them and consumers become more comfortable tapping their card for instant purchases. In Italy, for example, e-commerce transactions have soared 81% since February. For financial institutions, investing in the latest card-based technology so that your account holders have access to the convenient payment methods they crave is key.

Other Contactless Payments Options

Mobile payments apps. Mobile payments apps have grown in popularity with consumers. While Asian consumers outspend the rest of the world on in-app purchases, North American shoppers spend three times more on single transactions than the average Asian user, according to this report.

In a post-coronavirus world, we will likely continue to see in-app purchases rise. Gen Z has no memory of life without a mobile device—a smartphone, no less—glued to their palms; as they begin to expand their economic power, non-traditional purchase methods and peer-to-peer payments will likely rise.

Mobile wallets. Relatively new on the scene, such mobile wallets as Apple Pay give consumers the ability to make purchases with their smartphones—via stored card information. While smartphone ownership in the U.S. is among the highest across the globe, the velocity of mobile wallet adoption has been much slower. Projections made in 2019 anticipated that payments made from a mobile wallet were only expected to climb to 22% adoption by 2022. The coronavirus may very well drive this number way up as more and more people across the globe search for ways to minimize their cash interactions.

Practical Next Steps for Financial Institutions

As we enter into new and uncharted waters in nearly every aspect of our lives, one thing that’s certain is that the world is going to be different on the other side of this virus. Keeping up with consumer trends in payments preferences is going to be paramount, and the ability to adapt quickly to the market will be rewarded.

Demitry Estrin, CEO of The Futurist Group, said in a statement that, “The coronavirus could be the tipping point for contactless in the United States. The question has always been ‘what will get consumers to change their payment behavior?’ Given coronavirus fears, I think we now have the answer.”

Ali Masoudi is a product manager for CUES Supplier member SWBC, San Antonio, Texas. To learn more about evolving payment preferences, download our free ebook, “Equal & Opposite Reactions: Payments Preferences Across the Generational Divide.”