6 minutes

Move from chasing “volume” to getting paid appropriately for all risks taken.

Financial institutions are in the business of taking calculated risks, but it is the responsibility of the asset/liability committee to measure and manage those risks—and to ensure the institution is compensated for taking them.

Consider the following:

- The Federal Reserve’s Open Market Committee’s tightening strategy has already delivered 3.75% of rate hikes since March (interest rate risk)

- Depositors are in the early stages of using and/or investing funds elsewhere (liquidity risk)

- Indicators abound that recession is already underway (credit risk)

All three of these potential risks have now come into play at a record pace. The implication for institutions? ALCO and board discussions should be changing, strategies adjusting and internal feedback loops shortening up.

A Turning Tide

For many, the third quarter of 2022 again produced solid loan growth, and higher interest rates contributed to wider spreads and net interest income. The industry remained focused on deposit betas or how rates paid on various deposit products are increasing as the FOMC hikes.

For most institutions during Q1 and Q2, deposit rates showed very little correlation to FOMC policy. The deposit rate “lag” strategy has since come to an end and with the FOMC still increasing rates thru at least the end of this year, the industry is just starting to feel the pain of rising interest rates as the cost to retain deposits is climbing and dollars are moving. This will undoubtedly result in the beginning signs of margin compression unless properly addressed.

This exact trend played out in prior rising rate cycles where the cost of deposits was mostly unchanged through the first half of the cycle.

It wasn’t until the second half of the rising rate cycle that institutions absorbed the cost of higher deposit rates and betas increased notably.

This should be of concern, given that the Fed governors continue to indicate that their work is not done. One must expect deposit rates to increase more from here, creating pressure on margin for at least the next several quarters and bringing lagging loan yields to light. DCG’s deposit forecasting solution, Deposits360, is currently projecting deposit cost to increase thru 2023 and likely for a time even after the FOMC pauses on increasing rates.

Deposit Balances in Decline

Evidence abounds of deposit balances in decline and excess liquidity beginning to run down. With growing frequency, institutions are citing municipal deposit runoff, corporate clients moving large balances, exception pricing to retain relationships, and the mix shifting towards higher-cost share certificates and money market deposit accounts. Certificates of deposit are closing out early as depositors are opting to exercise early withdrawal and renew the CD at significantly higher rates and returns today. At the same time, Federal Home Loan Banks and deposit networks are reporting elevated activity as loan growth needs to be funded with something other than local deposits and cash liquidity.

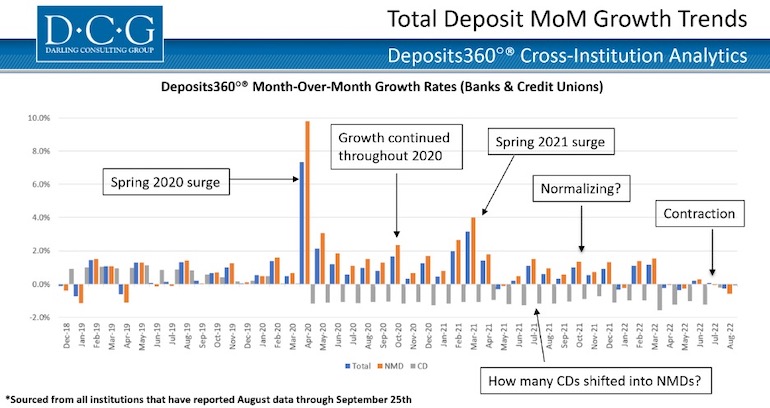

DCG’s cross-institution analysis, which tracks industry-wide deposit balances, shows back-to-back months of deposit contraction since March.

DCG sees approximately 37 basis points of pent-up pressure on nonmaturity deposit costs today. If the FOMC moves short-term rates at this coming December meeting and continues to pursue higher rates into 2023, DCG’s forecasted models expect that pressure on deposit costs could double.

Talking About Loans

DCG participates in ALCO meetings with institutions across the U.S. As a general observation, lenders at banks and credit unions continue to have local examples of the “competition” pricing loans with a low 4% handle and narrower spreads over indices, often with extended terms and lesser credits. Irrational loan rates and structures still exist.

With that, here is a summary of loan conversations led by DCG at the institutions we work with daily.

Pricing for elevated risk in the loan portfolio is what I believe is the most underappreciated strategic discussion right now. DCG has been running loan beta stress testing on net interest income projections to identify the potential exposure caused by narrowing spreads or the failure to increase loan rates in conjunction with higher market rates.

With a 50% beta applied to assumptions for loan rates in rising rate scenarios, the results are painful but insightful. The results show how projected rising rate sensitivity (a benefit for many), and earnings could and will change without action. Also, even if there is no change in sensitivity under this scenario, it does clearly quantify the significance in dollars of money being left on the table in the form of lost income from lower loan yields.

As a general observation, the 50% reduction in projected higher loan rates may not be enough of a reduction at some institutions, given their pricing.

How much have rates on loan products increased at your institution in comparison to the first quarter of this year? Tighter loan spreads have an adverse effect on overall margin and are set to become more apparent and obvious as deposit rates accelerate and higher-cost wholesale funding is used to support loan growth and/or deposit attrition.

Take the opportunity to educate your lending staff on the escalating cost of deposits and wholesale funding (the “raw materials” available to “manufacture” your loan products), as well as the realities of today's market interest rates.

The prime swap markets today show term rates from three to 10 years at 6.50% to over a 7.00% rate. This is “just” what you should be compensated in the form of interest rate for extending out on the curve today and taking interest rate risk (“locking in” fixed rate). A rate of 6.50% has no pricing component cooked in yet for credit, liquidity or prepayment risk.

Separately, compare loan rates to government-backed bonds that are trading today at discounted prices and net yields above 5%. The yield on a total loan portfolio (and margin) will be much slower to respond as the portfolio takes time to churn over. Unfortunately, this will not be a quick fix.

There is no crystal ball detailing what risks will come in this next cycle, but evidence is abundant that deposits are becoming more expensive and harder to come by while recession odds grow and historically go hand-in-hand with deteriorating credit quality.

Time to Change the ALCO Conversation

The DCG team has been changing the conversation at financial institutions for more than 40 years in every state in the U.S. Given today’s changing tides of interest rate, liquidity and credit risk, there is no better time to change the loan conversation from chasing “volume” to getting paid appropriately for all risks taken.

Keri Crooks is managing director at Darling Consulting Group, a CUES Supplier member. She joined the DCG team in 2002. She presently consults directly with ALCO groups and boards of directors at banks and credit unions about asset/liability management with the goal of enhancing high-performing institutions. She takes a hands-on approach at developing strategies to best fit the risk profile for each institution’s balance sheet, while also balancing trends and pressures alive in the current industry. Additionally, Keri remains actively involved in advancing Liquidity360°®, DCG’s proprietary liquidity risk management software, and is a frequent author on balance sheet management topics. Keri received a B.S. in business administration/finance from the University of Massachusetts at Lowell and currently resides in southern New Hampshire with her family.