6 minutes

Tips for preparing to handle an increased volume of problem loans while ensuring prudent credit risk management.

This article was adapted with permission from the original.

Now’s the time to prepare for managing increased loan workouts and loan modifications.

Loan performance since the pandemic has remained strong across many U.S. financial institutions in recent quarters, but credit unions and banks are boosting provisions for credit losses in anticipation of tougher times ahead.

In addition, prudential regulators have repeatedly encouraged financial institutions to include loan modifications in their actions to mitigate adverse effects on borrowers resulting from extreme weather, COVID-19, rising interest rates and inflation. They’ve highlighted specific concerns about credit risk management practices, particularly for commercial real estate.

Here are several tips for banks and credit unions looking to get ready to handle potential loan modifications or even loan workouts so they can maintain strong credit risk management.

Workout Volume May Increase

Despite the low volume of modifications at many institutions since the pandemic began, signs point to increased activity in the quarters ahead.

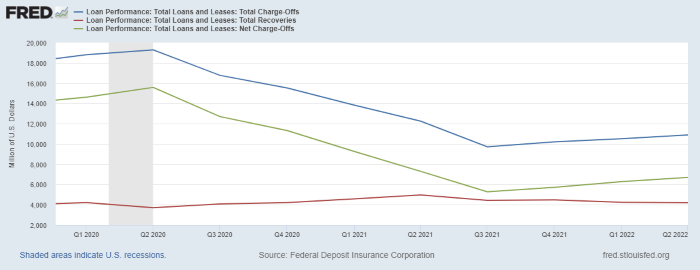

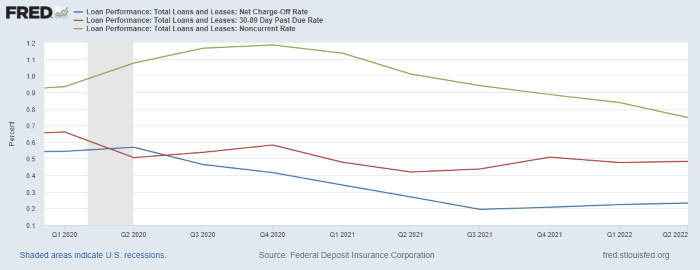

Overall, FDIC-insured commercial banks and savings institutions aren’t seeing dramatic increases in net charge-offs (Chart 1) or rates related to declining asset quality (Chart 2), such as past-due rates and rates for non-current loans. However, institutions in recent quarters are seeing some indicators of weakening asset quality.

“Right now… most institutions aren’t seeing increased charged-off loans,” says Abrigo Advisory Consultant Zach Englert. “The only real deterioration we’re starting to see is in subprime auto and credit card portfolios.” Even as news headlines announce that “the sky is falling,” many Abrigo clients are relaying they can count only six or seven charge-offs since 2015 or so, he added.

Nevertheless, some clients have said they recognize that more loan workouts could be on the horizon. Among the factors behind these concerns are:

- inflation’s impact on costs

- higher interest rates

- labor shortages resulting in the use of higher-cost, outsourced labor

- proactive hedging on supplies that can put stress on liquidity

Earnings reports also point to some deterioration in asset quality. Several institutions in recent weeks have reported that third-quarter non-performing loan rates ticked higher in 2022, despite being flat or in some cases below rates a year earlier.

In addition, financial institutions in the third quarter 2022 boosted provisions to create increased allowances for credit losses, whereas a year ago, the release of previous provisions was benefitting net income.

In a recent Abrigo survey, more than three-quarters of C-level, credit management and credit administration staff identified credit stress on current loans as a concern given the current rising interest rate and credit risk environment. Almost half of the nearly 200 bankers surveyed said they are concerned about an increase in modifications, workouts and charge-offs, and 62% identified needing to enhance current credit risk management analyses and processes as a concern given the environment.

Meanwhile, regulators are focusing fresh attention on prudent credit risk management of loans, especially CRE, and loan modifications in general.

Regulators Foster Prudent Loan Modifications

Loan modifications include, but aren’t limited to, a forbearance agreement, a new repayment plan or an interest rate modification. More extensive loan workouts can include a renewal or extension of loan terms, an extension of additional credit, or a restructuring with or without concessions.

Loan modifications have played an important role in the ability of borrowers to endure the impact of the pandemic, and regulators continue to urge credit unions and banks to work prudently with borrowers facing stress.

In 2020, federal and state banking regulators eased pressure on coronavirus loan workouts, urging financial institutions to work with their borrowers and members affected by COVID-19. Agencies agreed that these FIs would not be required to categorize as troubled debt restructurings those loan modifications made in good faith in response to COVID-19.

Under normal circumstances, a modification would generally be considered a TDR when the new terms represent a concession—terms that are not market-available. The TDR designation prompted a requirement for separate accounting using discounted cash flow models.

Create a Plan to Manage Problem Loans

So, what can a financial institution do to prepare for an increased volume of loan modifications or loan workouts?

Abrigo advisors note that successful, high-performing financial institutions will:

- Review and update as necessary their policies, processes, and procedures for loan modifications or loan workouts. “If you haven’t updated your policies and procedures or dusted them off in five or seven years, the time is now,” says Abrigo Advisory Services Senior Advisor Paula King, who has assisted institutions with policy reviews and updates.

- Add training on loan modifications and workouts. Many staff members may have joined since 2015 and therefore lack experience working on modifications.

- Review any system to manage requests or identified loans at elevated risk. This assessment will help ensure the credit union or bank can prioritize loan accommodation needs and manage the associated risk while maintaining profitability. Automated loan modification can save time and improve efficiency, King says. Importantly, loan modification software can ease the burden of the numerous, highly manual steps typically involved in modifications and workouts.

More Advice for Managing Loan modifications, Workouts

Abrigo Senior Advisor Rob Newberry has noted that lenders with successful strategies for managing credit risk related to loan modifications also incorporate the following:

Specific legal expertise in crafting agreements. As these agreements override the original loan documentation, the lender can gain more flexibility to call the loan or require additional collateral based on the new terms and covenants of the workout agreement.

- Methods to include and track additional review and due diligence on the borrower’s existing loan documents

- Straightforward, measurable new terms and covenants for the borrower

- Expectations outlined to ensure the borrower has the ability—and desire—to follow through

- Borrower’s potential recovery of their equity position tied to the par recovery of the original loan profitability basis, at minimum. Present-value recovery for the financial institution can inform an argument that the new terms do not represent a concession.

- Negotiation between impacted customers and personnel who have a direct interest in the health of the financial institution

- Timely, authoritative, accurate information on the state of the borrower with all participants on the lender side communicating the same message

- "What-if” scenario stress testing to examine the impact on the portfolio and capital levels if charge-offs increase as expected.

Getting prepared for additional volume in loan modifications and workouts is especially vital for smaller, less complex lenders that lack the resources of large financial institutions. Taking steps now will help these credit unions and banks provide personal, prudent service while scaling institutional resources to handle added volume.

Mary Ellen Biery is senior strategist and content manager at Abrigo, where she works with advisors and other experts to develop whitepapers, original research and other resources that help financial institutions drive growth and manage risk. A former equities reporter for Dow Jones Newswires whose work has been published in The Wall Street Journal, the Washington Post, and on Forbes.com, she is a frequent author in banking, credit union and accounting publications.