5 minutes

Nine of 10 retirement plan participants surveyed said using a holistic financial fitness program helped them.

More employers are graduating from retirement education programs and moving up to a more holistic financial fitness model designed to help employees improve their short- and long-term financial health.

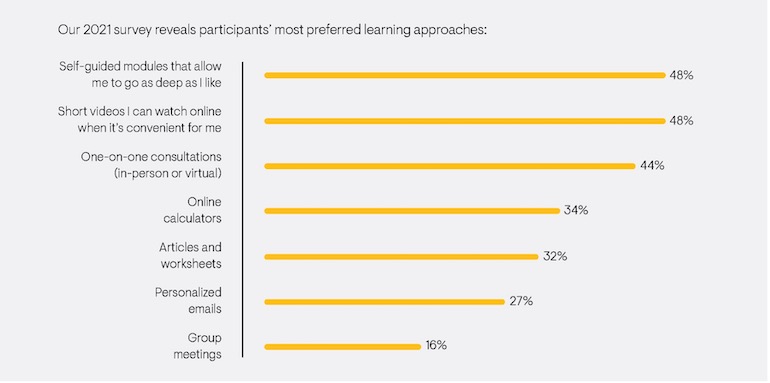

If your credit union is thinking about ways to enhance financial fitness within your benefits programs, the results of Cuna Mutual’s 2021 Retirement Participant Education Survey offer some insight into the features employees would find most helpful in a financial fitness program.

In February and March 2021, Cuna Mutual Group surveyed more than 15,000 participants of its defined contribution retirement savings plans. At that time, the COVID-19 pandemic had certainly injected a sense of urgency around short-term financial matters for respondents and their employers.

The survey results suggest tactics to promote financial preparedness and resiliency in the wake of the pandemic and beyond:

1. Embrace a Holistic Employee Wellness Plan

Retirement planning is critical for your plan participants: Only 24% of survey respondents said they knew how much they’d need to save for a comfortable retirement. But retirement is only one source of financial stress for employees.

Other indicators of overall financial wellness include the ability to cover routine expenses, own some type of emergency fund, save toward a long-term financial goal, and have some flexibility to pursue personal interests or hobbies.

Financial healthy employees are well-positioned to contribute successfully toward work objectives and interactions with peers. Promote information and tools your employees can use to address all these facets of financial well-being.

2. Recognize and Meet Employees’ Diverse Financial Needs

Financial needs and anxieties vary widely by age, gender, years on the job and other factors. The survey showed that employees’ preferences for financial topics broke down the way you’d probably expect according to age.

Younger participants were more likely to value learning about saving, basic investment principles, budgeting and managing debt. Older participants showed more interest in strategies for transitioning into retirement, claiming Social Security deductions, and tax or estate planning.

But age isn’t the only focus of financial fitness program content. Try to learn your employees’ main financial concerns and provide content to address them. For example, survey participants were asked about additional topics they may find valuable in financial education programming. Their suggestions included:

- Health insurance

- Options for becoming debt-free while saving for retirement

- Tax implications and retirement forecasting

- How to choose the right investment options

3. Deliver Financial Education and Planning in Ways That Suit a Broad Range of Preferences

An effective financial education program makes planning and learning resources easy to access, convenient and flexible.

4. Provide a Complete Range of Financial Education Content

The survey results confirm that financial uncertainty and stress are common among retirement plan participants, and the pandemic has only made this worse. While growing up and entering the workforce, many of us didn’t learn fundamental personal finance skills. Your financial fitness program can fulfil this need with content and tools focused on such topics as:

- Understanding credit

- Managing debt

- Compounding interest

- Using tools and calculators

5. Track Plan Metrics

Some financial education programs include interactive data analytics dashboards that employers use to measure their employees’ overall engagement with the program, including popular topics and retirement savings progress—while respecting employees’ right to privacy. It can be helpful to understand, broadly, which demographic groups tend to use certain learning modules and tools, and which topic areas and delivery formats are most popular.

6. Use Data and Employee Feedback to Inform How You Promote These Tools

In addition to benchmarking data in Step 5, get employee feedback to help you assess your program’s features. Use this information to create promotional materials. Publicizing key metrics may help employees see, for example, how their retirement plan contribution rates stack up against the plan’s overall average.

Also, by sharing with employees which content, tools, and media are currently most popular, you reinforce all the resources they have available.

7. Promote Your Program

Unless you actively promote your financial fitness plan regularly, through a variety of channels, you’re not making the most of your investment in employee benefits. Work with your plan provider to offer in-person and/or virtual presentations on how to use your financial fitness program features.

Encourage employees to track their own progress. Offer appropriate rewards and recognition to employees or groups who achieve certain benchmarks. And repeat educational and promotional programs often.

Help Employees Retire on Time

When employees don’t retire because they believe they can’t afford to, it hurts everyone involved. It can’t be good for employees’ attitudes and performance if they’d rather not be working anymore. There are impacts to co-workers—especially those who may be blocked for promotions. It just makes sense that financially healthy employees contribute more to their workmates, organization and communities served.

Karnail Kooner is a retirement specialist with CUESolutions provider CUNA Mutual Group, Madison, Wisconsin. Download an infographic with further insights into the results of Cuna Mutual Group’s 2021 Retirement Participant Education Survey. Or call 800.356.2644 ext. 665-7321 to learn more about CUNA Mutual Retirement Services’ Financial Fitness program.