10 minutes

Why loan officers and financial departments must work together

“There are...wait for it...43,252,003,274,489,856,000 ways of arranging the squares, and only one of these is the solution. Turn and twist away—can you solve it?” Can you guess what that quote is referring to? If you guessed the Rubik’s Cube, you’d be right.

How many of us played this mind-teasing game as kids, and probably adults, for hours on end, trying to find all the connections and make the right moves to solve the puzzle? The twists and turns you makedetermine each subsequent action, which involves a lot of intentionality and precision, and ultimately leads to finding the right solution. Well, for some of us, anyway!

You may not realize it in your day-to-day role at the credit union, but the same process is true of lending and its impact on the overall earnings and risk. Those connections and the careful, calculated moves are exactly what you need to figure out how to find a balance between your lending strategy and your balance sheet.

Like the Rubik’s Cube, the lending team needs to understand the full financial goals of the credit union to make sure their turns align with the larger credit union position. Since all of these pieces are intertwined, let’s explore those relationships a little more to gain a better understanding of the role of the loan.

Earnings

Let’s first start with how financial institutions earn money. The structure is vastly different to most businesses, and it’s important to understand how it is unique. For example, a manufacturing business takes raw materials and create a product they can sell. The costs to produce said product include raw materials, employee salaries and benefits and the machinery to make the product. Their earnings are made in the difference between the production costs and the sales price.

On the other hand, while credit unions also sell products—loans, share accounts, etc.—the way we earn revenue is not on those solutions themselves; it’s in the form of interest rates. Our earnings are made because loan rates are higher than share rates. The products create both income and expenses based on interest rates, which means they are impacted by market changes. This is where the risk comes in to play with earnings.

Rates

For rates, the spread—the difference between the higher loan rates and lower share rates—partially denotes the all-important mismatch in terms. Because loans are longer term and carry credit risk, they have higher rates, which creates earnings. Unfortunately, it also creates risks. The longer the term, the greater the risk.

As market rates rise and fall, they take a toll on the credit union earning structure of buying money in the form of shares and selling money in the form of loans. That’s because market rates impact interest rates. When rates increase, the credit union cannot increase the rate of a fixed loan. That power lies in the hands of the member, who is responsible for paying back the funds but at a rate unchanged by market activity. So, whether the loan is paid off early or it goes to maturity is out of the credit union’s hands.

As interest rates rise, it adds pressure to earnings. If the institution is flush with liquidity, there is not as much incentive to increase rates on shares since they do not need to retain or bring in more money. However, once liquidity is needed, the share rates increase to encourage members to deposit additional funds or to keep their funds at the credit union. An increase in funding rates means an immediate rise in costs for non-maturity share accounts. Since this is where the majority of the deposits are held, this instantly increases those costs and minimizes the spread—meaning decreased earnings for financial institutions.

This is what we’re experiencing in today’s environment, as institutions begin to increase share rates in response to dried up liquidity.

Risks in Action

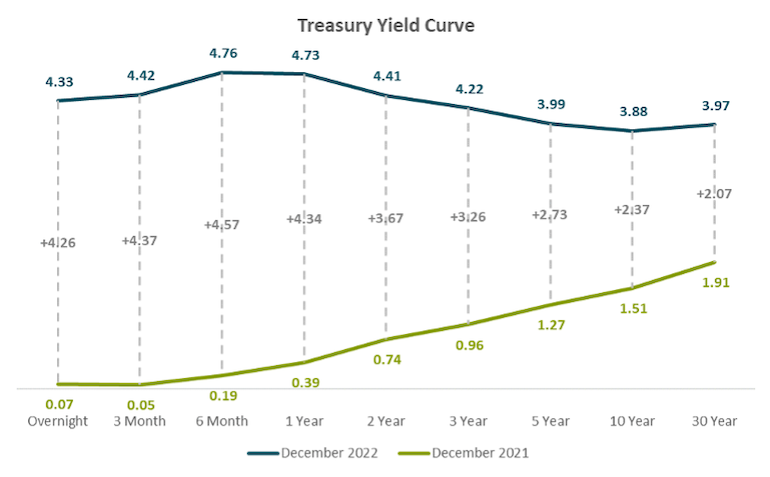

So, what do these risks look like in action? If we look at the U.S. Treasury yield curve, we see a couple of things. The first is the large increase in rates, which represents the Federal Reserve’s rapid rise in the Federal Funds Target rate—the rate credit unions earn on overnight excess cash.

The green line on the graph represents rates in December 2021 and the blue line represents rates in December 2022. As of December 2021, the overnight rate was seven basis points. Enter the Fed’s aggressive rate-hiking campaign to fight pandemic-driven inflation, and the rate as of December 2022 was a much higher 433 basis points. That’s quite a jump, and it shows us there’s been a non-parallel shift in long-term loan versus short-term share rates.

Because share rates are priced based on the short end of the curve and loans are priced based on longer term treasuries, there is a disproportionate change in rate increases. The overnight rate has increased 4.26% while the 10-year treasury has only increased 2.37%. This type of activity hasn’t been seen since the early 1980s, and it’s causing substantial changes in the market for both shares and loans. Now, let’s look at this trend over a wider period of time, as shown in the graph below.

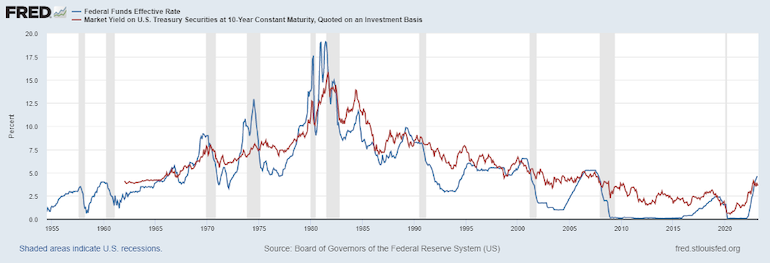

What we see here is the 10-year treasury rate in red and the Federal Funds rate in blue, with recessions indicated by the vertical gray bars. Since the 1960s, there has generally been a positive spread between the two rates—except in some instances where the Federal Reserve increases the Federal Funds rate. In these cases, the overnight rate outpaces the 10-year treasury rate. This is the case today. History shows this kind of activity is often followed by a recession, which is not necessarily a guarantee, but a possibility.

The Pieces Align: What are the Repercussions?

Yield curve rates and their response to the market are integral pieces of the puzzle (or, in this case, Rubik’s Cube), and they are certainly outside of our control. However, there are pieces we do have some power over that can influence how earnings risks will play out in credit union profitability. We’ll turn now to the funding side of the discussion.

Credit unions do not adjust their share rates exactly with the short-term market change, but they are in control of two things. The first is when the rate changes. The rate is variable and can change at any point, and it is up to the credit union when this happens. The second control feature is how much they pay for the shares. The short-term rate is only a part of the decision on the rate to pay for funding.

But let’s not forget about another driver to the rate paid for shares: how much liquidity the credit union needs. Liquidity is the amount of liquid funds the credit union holds for things like share withdrawals or funding new loan growth. If levels get too low, the balance of shares needs to increase. The motivation for consumers to deposit funds is the share rate. Liquidity is also dependent on the level of loan growth the credit union is experiencing.

In other words, if your credit union has $10 million in cash and loan growth is $7 million, this leaves only $3 million in liquidity. This is where the finance department and the lending department need to come together and make a plan to maintain a healthy level of liquidity. They may choose to increase the share rate to entice members to deposit more funds, leading to higher deposits and greater liquidity. They may decide to temporarily put the brakes on loan growth to ensure the liquidity safety net remains available. In this case, they may make the decision to pull back funding $7 million in loans to just $5 million.

Another option is to sell whole loans or portions of loans via loan participation based on the current market, which will determine the sales price. This can be tricky, because when loans are originated at lower rates of, let’s say, 4%, and current loans are originating at higher rates, perhaps 7%, the loans have become less liquid and therefore less valuable. In this situation, the loans may not attract any buyers because of their low yield, or the credit union will have to sell them at a loss, neither of which is ideal.

Making the Right Moves in a Rising Rate Environment

Just like a Rubik’s Cube, all these puzzle pieces—the market, the rates, your liquidity needs—will help to determine your next moves, particularly in a rising rate environment like the one we’re experiencing now. Sure, rates may be climbing, but we know they can’t increase indefinitely. At some point, the cycle will change and rates will come down. That means we need to think longer-term and prepare to position the credit union for future earnings with fewer risks.

In times like these, a renewed focus on increasing loan pricing is critical. We’re able to do that because of the uptick in the Fed’s rates, but also because it’s necessary to combat the rising costs of higher rate shares. Remember, loans have longer terms, often with fixed rates, so increasing the rates on newly issued loans helps to boost the overall earnings of the loan portfolio. Then, when the time comes to increase share rates, the loan portfolio is in a better position to handle the higher cost of shares, which will soften the impact on the credit union’s earnings. These higher loan rates are also helpful when rates fall, because the fixed-rate, long-term conditions of loans will continue to keep earnings higher.

What a Recession Means for Lending, Earnings and Risk

Since the pandemic began, loan defaults and credit risk have been mild or even close to non-existent thanks to stimulus funds and other factors. As we see liquidity starting to dry up, a recession would likely mean the return of both.

At the same time, it’s expected loan growth will slow down significantly. Because of members’ uncertainty about the economy and our inherent need to tighten credit exposure within our institutions, loan volume, as well as loan rates, will surely decline.

While we can’t say a recession is imminent, it’s best to know how earnings are impacted in both rising and declining rate environments. Use this time to do some reforecasting in both rate environments while layering in liquidity planning as we move forward in a very uncertain market.

The Rubik’s Cube company probably got it right when they said there are “43,252,003,274,489,856,000 ways” of assembling the pieces to solve the puzzle. What they didn’t realize was just how well that would translate into the riddle that is loans, earnings and risk from a financial institution perspective. The solution lies in knowing how all these working parts are connected and marrying your lending and financial strategies in a way that benefits the credit union overall. Maybe, just maybe, playing with the Rubik’s Cube was a way of preparing us for these challenging times and the tasks that lie ahead!

Melissa Scott is VP/ALM services at $5.2 billion Vizo Financial Corporate Credit Union, Greensboro, North Carolina.