8 minutes

What credit union execs, HR and managers can do to make M&A transition.

Sponsored by CUES Supplier member Lattice.

While mergers and acquisitions (M&As) can represent a new opportunity for growth at a credit union, they typically create more fear than enthusiasm at the employee level. From the executive team to the tellers, employees will wonder what their place will be in the changing organization—or if they’ll even have a job going forward.

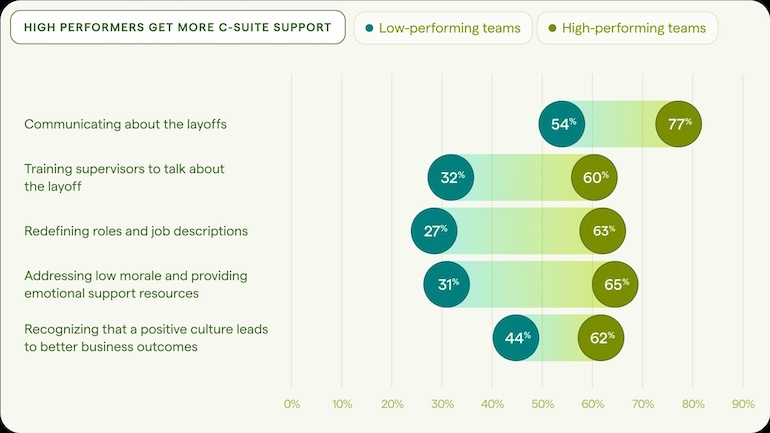

Lattice’s 2024 State of People Strategy Report found that in the best-case scenarios, HR teams felt supported by executive leadership during several stages of layoffs and mergers—not just the initial communication about the changes.

So as credit union M&As become increasingly likely in 2024, it’s essential to consider the implications on your workforce—because when people thrive, business thrives. Executives, HR teams, and managers can work together to mitigate voluntary employee turnover prompted by the M&A and ensure a successful transition. Here’s how.

What Executives Need to Do During Mergers & Acquisitions

Leaders are in a difficult situation during transitional periods of M&As. Executives are responsible for ensuring the best future for the credit union, which requires discretion and sensitive handling of confidential information until the deal has been officially announced. Yet great leaders know that silence and secrecy wreak havoc on employee morale and cause confusion for the workforce. Here’s what executives need to do to strike the right balance.

1. Involve the necessary people from the beginning.

“The fear of word-leaking prevents many sellers from bringing key managers crucial to the people integration element into the conversation early on,” cautions Martha Sullivan, CPA, founder and president of Provenance Hill Consulting, an exit-planning consulting firm. As a result, credit unions may not perform the proper due diligence, and “[the leadership] team ends up ill-prepared to support their colleagues through the transition,” she adds.

But leaks are nearly inevitable, says Debbie Nathanson, executive coach and HR strategic business partner and consultant. She recommends involving human resources as soon as possible to mitigate potential damage.

HR can advise executives on how to manage leaks and help determine what information, if any, can be shared with employees to ease their anxieties.

“The best thing executives can do is make sure they’ve pulled in the right people upfront, so they can think through all the necessary pieces,” Nathanson says. For CUs, this also means involving IT teams early on to plan for the complex online banking systems integrations to ensure business continuity.

2. Think about culture early on.

Organizational culture can take a backseat to seemingly more pressing matters during M&As, like the deal’s structure, necessary due diligence, and bidding and negotiating. But without a plan to merge two cultures in addition to the rest of the organizations, credit unions may struggle with employee retention after the deal is complete.

The cultural aspect of merging two credit unions can vary in difficulty and complexity, so it’s crucial to think about it from the start—consider the similarities, differences and priorities—and build that into the M&A process.

One way to do so is to survey employees at both credit unions to ask what their organizations' most important and emblematic features are. To avoid arousing concern or confusion, the survey can simply be framed as a pulse survey on culture, or as part of a longer engagement survey. Executive teams should work with HR to conduct the survey and build a plan to merge cultures with this information in mind—another reason HR should be involved in the M&A process as early as possible.

3. Share what you can and be authentic.

Within the confines of what’s legal and permitted, the leadership team should share information when they can to keep employees from assuming the worst-case scenario, which is common when there’s a lack of information. “Be as transparent as you can be, so [employees] know what they’re dealing with. Or at least tell them you don’t yet know,” advises Nathanson.

Telling employees that there’s information you don’t know or aren’t yet able to share might be frustrating to them, but ultimately, that honesty and transparency will build trust. “Nobody believes that nothing will change, so strike the right balance in tone and message to offer calm and meaningful information about what the future holds,” Sullivan says.

What HR Teams Need to Do During Mergers

As the people center of an organization, HR is tasked with several responsibilities during M&As. They’re likely to be in charge of drawing up new roles, retention agreements, effective communication strategies, and plans for ensuring business continuity, all while navigating their own uncertainties about what the future holds.

1. Monitor ongoing employee engagement.

Credit unions, community-focused by nature, pride themselves on being great places to work. When merging, acquiring, or expanding into new markets, HR needs to keep a pulse on employee engagement, monitor employees’ adjustment, and incorporate feedback when needed to retain a meaningful employee experience.

Engagement surveys are a great way to collect and track feedback over time. At $11 billion GreenState Credit Union, North Liberty, Iowa, which has grown largely through acquisitions in recent years, Lattice provides a single, centralized hub for surveying employees and accessing feedback, giving their HR team the data they need to develop and implement strategies to address any employee concerns about the transition.

Survey response rates are excellent at GreenState CU, with an average 90% completion rate. “I'm finding that I'm actually getting into dialogue with employees, and we're taking action on their feedback,” says Pam Peters, engagement and culture director at GreenState CU.

2. Accept that some voluntary turnover will occur.

Despite HR’s best efforts, it’s likely that voluntary turnover will increase during an M&A. Employees may resign even after layoffs are complete or wait out the stipulation of their stay bonus and then leave immediately after that.

“The best way to [prepare] for this is first to acknowledge that it’s more likely than not to happen,” advises Lori Scherwin, executive coach and founder of Strategize That, a New York City-based leadership consulting firm. “If you are expecting turnover, it won’t be as painful when it happens.”

What Managers Need to Do During Mergers

As the liaison between leadership and employees, managers are in a difficult position during M&As. Fielding questions and concerns from employees while trying to keep teams focused on day-to-day operations—and managing their own concerns about the looming organizational changes—is no easy task. Here’s how managers can help this process go smoothly, for themselves and their teams.

1. Communicate directly and with discretion.

News of an M&A almost always leaks before the official announcement is made. This can be difficult for managers, who are trying to be transparent with their teams without disclosing sensitive or confidential information.

“As a leader, you need to be honest while mindfully towing the company line,” Scherwin says. “It’s okay to tell your team that you know change is coming, but don’t yet know the specifics.”

While it may be tempting to deny employee suspicions to keep the peace, it’s best to communicate—even if that means saying you don’t know or can’t share more. Saying something is better than saying nothing to allay employees’ worries and fears.

2. Empathize but don’t complain.

Managers are likely feeling anxious about what the M&A means for their own job security, role responsibilities, career growth, team changes and more, but great managers should do their best to remain calm and clear-headed despite their concerns.

“The thoughts you’re having [as a manager] are the same thoughts your team members are having—but they are looking up to you to provide support,” Scherwin says. “Listen to their concerns and actively develop solutions. Don’t let your own fears get in the way of coaching and developing your people.”

Allow team members to vent to you but avoid joining in, she advises. Instead, redirect the conversation to the potential positives of the situation, like the opportunity to develop new skills and experience.

3. Talk to the employees you want to stay—especially new team members.

For managers, M&As may mean onboarding new team members. If that’s the case, it’s imperative to reach out to new employees as soon as possible after the announcement is made. Nathanson recommended saying something along the lines of: “I’m hearing wonderful things about you. We’re really hoping you’ll stay, we have a job for you. Please stay and work this out with me.”

This personal outreach is bound to carry more significance than hearing from HR that the employee still has a job after the deal is done. What’s more, this initial contact is an opportunity for a positive interaction as the manager-employee pair begins their new relationship.

When People Thrive, Business Thrives

M&As are challenging at every level—but HR can’t be left to manage them alone. While executives, people teams and managers will be responsible for different tasks, all will benefit from communicating effectively and sharing as transparently as possible to ensure a smooth transition—and a happy workforce.

M&As at credit unions can be chaotic times that require executives, HR professionals and managers to remain focused on the tasks needed to usher the deal through. As you do due diligence, meet with board members, and iron out the details of the deal, it’s essential to also prioritize the people who have made your credit union a success so far—and will help shape its future success after the M&A is complete.

Halah Flynn is a senior content marketing manager at CUES Supplier member Lattice with eight years of experience producing content for human resources and higher education institutions, prioritizing authentic journalism, customer education and accessibility.